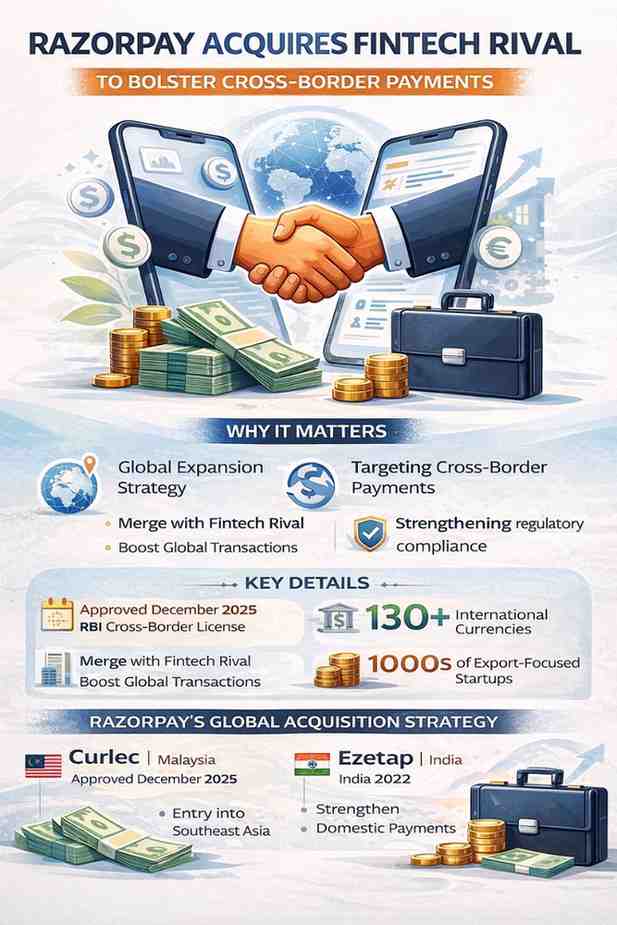

Razorpay Acquires Fintech Rival to Strengthen Cross-Border Payments: What It Means for Indian Businesses and Global Expansion

Why Razorpay’s Latest Acquisition Matters Today

India’s digital payments sector is entering a new phase of global competition.

Fintech giant Razorpay has intensified its expansion strategy by acquiring and merging fintech rivals to strengthen its cross-border payment infrastructure. This move comes at a time when Indian exporters, startups and global businesses increasingly depend on seamless international transactions.

Cross-border payments are now a key battleground for fintech companies. With global commerce shifting online, Indian businesses need faster, cheaper and compliant payment systems.

Razorpay’s acquisition strategy and recent regulatory approvals signal a clear ambition to build a global payments network from India.

Razorpay’s Acquisition Strategy: Building a Global Fintech Platform

Razorpay has steadily expanded through acquisitions to strengthen its technology and global presence.

One major development is the merger of Ezetap Mobile Solutions with Razorpay Payments Private Limited, which became effective from October 1, 2025. This merger transferred all assets and operations of Ezetap into Razorpay’s ecosystem, strengthening its payment infrastructure and merchant network.

This consolidation helps Razorpay offer:

- Integrated online and offline payment solutions

- Stronger merchant coverage

- Better international transaction processing capabilities

The company has also acquired multiple fintech platforms in recent years, including consumer payments and invoicing firms, as part of its long-term expansion strategy.

Focus on Cross-Border Payments: A Key Growth Priority

RBI Cross-Border Licence Boosts Razorpay’s Capabilities

One of the most important developments supporting Razorpay’s global ambitions is its regulatory approval from the Reserve Bank of India.

In December 2025, Razorpay secured the Payment Aggregator – Cross Border (PA-CB) licence, allowing it to handle international payments directly under regulatory supervision.

This licence allows Razorpay to:

- Facilitate both inward and outward international payments

- Support Indian businesses accepting global payments

- Enable transactions in 130+ international currencies

- Provide regulated cross-border payment infrastructure

This regulatory approval places Razorpay among a select group of fintech firms authorised to operate global payment services from India.

Supporting Indian Exporters and Global Businesses

Cross-border payment infrastructure is critical for:

- Exporters

- SaaS companies

- Freelancers

- E-commerce brands

- International companies operating in India

Razorpay’s platform enables these businesses to receive payments from overseas customers without relying on multiple service providers.

Earlier Fintech Acquisitions That Strengthened Global Presence

Curlec Acquisition Opened Southeast Asia Markets

Razorpay’s global expansion strategy began with its acquisition of Malaysian fintech firm Curlec.

The company acquired a majority stake in Curlec at a valuation of about $20 million, marking its first international acquisition.

This acquisition enabled Razorpay to:

- Enter Southeast Asian markets

- Expand recurring payment services globally

- Support businesses in Malaysia and other Asian regions

Curlec now supports thousands of local businesses and plays a key role in Razorpay’s international payment operations.

Expansion into Singapore and International Markets

Razorpay has also expanded operations into Singapore and other international markets.

This move helps businesses handle international payments more efficiently and reduce high transaction costs, which can reach 4% to 6% in some markets.

Such expansion strengthens Razorpay’s cross-border payment network across Asia.

Why Cross-Border Payments Are Critical for India’s Digital Economy

India’s digital economy is rapidly globalising.

Key drivers include:

- Growth in e-commerce exports

- Expansion of SaaS startups

- Rise of global freelance services

- Increasing international tourism and payments

Cross-border payment systems must support:

- Multiple currencies

- Global payment methods

- Regulatory compliance

- Fast settlement times

Razorpay’s international payment solutions allow businesses to accept global payments using cards, bank transfers and digital wallets. (Razorpay)

Technology and Partnerships Strengthening Razorpay’s Global Network

Razorpay has also strengthened its infrastructure through partnerships and technology integrations.

These include:

- Support for Apple Pay international transactions

- Partnerships to enable global UPI payments

- Integration with international payment systems

These initiatives improve:

- Payment success rates

- Customer trust

- Checkout conversion rates

They also help Indian businesses expand globally.

India’s Fintech Market: Increasing Competition and Consolidation

India’s fintech sector is one of the fastest growing globally.

Companies are expanding through:

- Acquisitions

- Partnerships

- International expansion

- Technology investments

Competitors are also investing in cross-border payment infrastructure, highlighting the importance of global payment capabilities.

Razorpay’s acquisition strategy allows it to:

- Expand faster

- Acquire technology expertise

- Enter new markets quickly

- Strengthen regulatory compliance

Strategic Benefits of Razorpay’s Acquisition and Merger Moves

1. Faster International Expansion

Acquisitions allow Razorpay to quickly expand into new countries without building systems from scratch.

2. Stronger Technology Infrastructure

Acquiring fintech rivals improves Razorpay’s:

- Payment processing technology

- Compliance systems

- Merchant integration capabilities

3. Larger Merchant Network

Mergers bring new customers into Razorpay’s ecosystem, increasing transaction volume.

4. Competitive Advantage

Global payment capability is now a key differentiator among fintech companies.

Companies that offer seamless cross-border payments gain a major advantage.

Impact on Indian Businesses and Startups

Razorpay’s expansion directly benefits Indian businesses.

Key advantages include:

- Faster international payment processing

- Lower transaction costs

- Access to global customers

- Simplified compliance and settlement

This is especially important for:

- Export-focused startups

- D2C brands

- SaaS companies

- Freelancers

India’s startup ecosystem depends heavily on global revenue streams.

India Emerging as a Global Payments Hub

India’s fintech companies are increasingly expanding internationally.

Razorpay’s growth strategy supports India’s position as a global fintech hub.

Key trends include:

- Cross-border digital payments growth

- International fintech expansion

- Strong regulatory support

- Technology innovation

India’s digital payment ecosystem is already among the world’s largest.

Companies like Razorpay are now building global infrastructure from India.

Future Outlook: Razorpay’s Global Ambitions

Razorpay’s acquisition and expansion strategy clearly signals long-term ambitions.

The company is focused on building:

- A global payments platform

- International merchant infrastructure

- Seamless cross-border payment systems

With regulatory approval, acquisitions and international expansion, Razorpay is strengthening its global position.

What This Means for the Fintech Industry

Razorpay’s acquisition and merger activity reflects broader fintech trends:

- Increased consolidation

- Strong focus on global payments

- Growing competition

Cross-border payments will remain one of the most important areas in fintech.

Companies that build strong global infrastructure will lead the next phase of digital payments growth.

Bottom Line

Razorpay’s acquisition of fintech rivals and expansion into cross-border payments marks a major step in its global strategy.

With RBI regulatory approval, international acquisitions and infrastructure investments, Razorpay is positioning itself as a key global fintech player.

For Indian businesses, this means easier access to international markets.

For the fintech industry, it signals a new era of global expansion driven by Indian technology companies.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Last Updated on Friday, February 13, 2026 11:16 am by Startup Newswire Team