Cabinet Approves ₹10,000 Cr Startup India Fund of Funds 2.0 to Boost Deep Tech and Innovation in India

Union Government Takes Major Step to Strengthen Startup Funding Across the Country

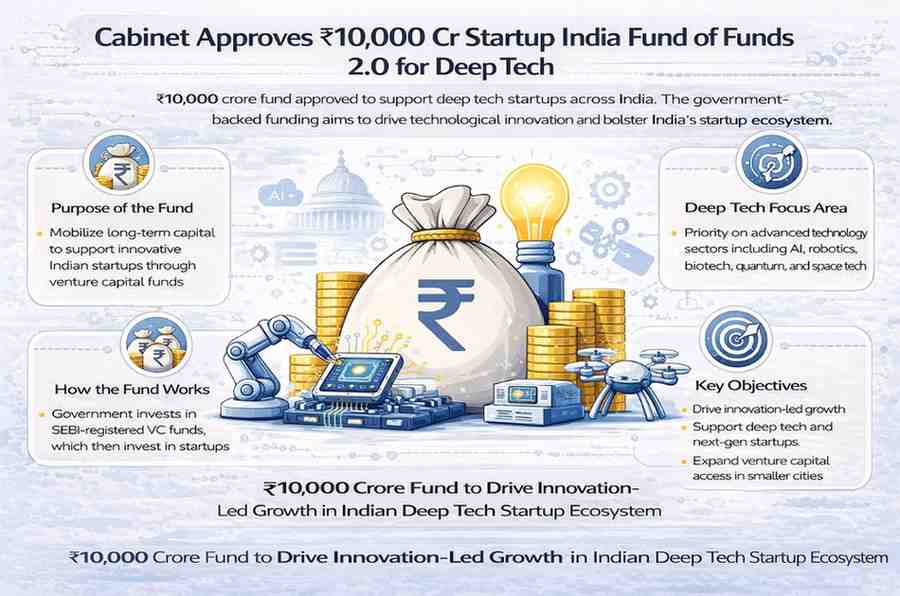

The Union Cabinet, chaired by Prime Minister Narendra Modi, has approved a new ₹10,000 crore Startup India Fund of Funds 2.0 to support the nation’s burgeoning startup ecosystem. This announcement on 14 February 2026marks a significant policy push to mobilise long-term domestic capital, especially for deep technology and innovative ventures.

The approval comes at a critical time when startups in India are seeking patient, sustained funding – particularly for ambitious projects in advanced technology and high-risk sectors. The move updates and expands the government’s flagship Startup India fund initiative, laying the foundation for the next phase of innovation-led economic growth.

What Is the Startup India Fund of Funds 2.0?

The Startup India Fund of Funds 2.0 (FoF 2.0) is a government-backed investment vehicle with a corpus of ₹10,000 crore. It is designed to channel government capital to private Venture Capital (VC) funds, which will then invest in startups across India.

This approach – investing through private funds rather than directly into companies – aims to leverage the expertise of experienced VC managers and accelerate capital deployment in early growth stages. The previous version of the fund, launched in 2016, helped mobilise private investment and strengthen India’s venture ecosystem.

Why This Approval Matters Today

India’s startup ecosystem has grown rapidly over the past decade. When the government launched the original Fund of Funds under Startup India in 2016, fewer than 500 startups were recognised nationally. Today, India is home to over 2 lakh recognised startups, making it one of the fastest-growing startup markets in the world.

The new fund focuses on:

- deep tech startups (AI, robotics, biotech, quantum, space tech)

- technology-driven manufacturing ventures

- early-growth stage businesses

- venture capital mobilisation beyond major metropolitan centres

This is expected to bridge funding gaps and ensure pioneering Indian innovators have access to the capital needed for long-term growth.

How the Fund Will Work

A Focus on Long-Term Capital and Innovation

Rather than investing directly into startups, the government’s FoF 2.0 will allocate its corpus to registered Alternative Investment Funds (AIFs) that meet specific criteria. These AIFs will use the government funding to back startups that require patient capital especially in sectors where funding risks are high.

This model strengthens the overall venture capital ecosystem by:

- Attracting domestic capital into early-growth companies

- Boosting smaller VC funds with institutional support

- Encouraging investments in regions outside major cities

- Backing founders working on long-gestation technologies

Targeting High-Risk, High-Impact Sectors

Deep-tech and advanced manufacturing startups often struggle to secure funding due to long development cycles and high risk. By directing capital to these areas, the FoF 2.0 aims to:

- Support cutting-edge research and development

- Strengthen India’s presence in global innovation markets

- Drive financial backing for local solutions in AI, biotech, clean tech, and advanced engineering

Building on a Proven Model

The original Fund of Funds for Startups (FFS 1.0), launched under Startup India, committed an initial ₹10,000 crore to more than 145 private funds. Those funds, in turn, invested more than ₹25,500 crore into over 1,370 startups.

This model helped nurture early-stage companies, crowd in private capital, and create pathways for new founders. Many startups backed during the first phase went on to attract further funding and scale operations successfully.

The FoF 2.0 builds on that foundation, sharpening the focus on deep-tech and innovation–led growth.

Key Objectives of the New Fund

The Union Cabinet approval outlines several core goals:

Mobilise Long-Term Domestic Capital

The primary objective is to channel sustained investment into startups via AIFs, expanding beyond short-term funding cycles.

Strengthen the Venture Capital Ecosystem

Smaller domestic VC funds often struggle to compete for capital. The new fund aims to strengthen these funds, making them better positioned to back local startups.

Support Innovative Entrepreneurship

The FoF 2.0 will prioritise companies that are driving technological breakthroughs with an emphasis on solutions that can compete globally.

Boost Regional Inclusion

By encouraging investments beyond major urban centres, the fund supports a more inclusive startup ecosystem across India.

Government’s Broader Startup Strategy

The approval of the Startup India Fund of Funds 2.0 fits into India’s larger startup and innovation agenda. Since the original Startup India initiative launched in 2016, the government has focused on:

- Simplifying startup recognition and compliance

- Offering tax exemptions and incentives

- Supporting incubation and acceleration programmes

- Scaling seed-stage funding opportunities

The latest fund demonstrates continued commitment to strengthening India’s leadership in technology and entrepreneurship.

Expected Impact on Startups and Investors

Stronger Capital Access for Founders

Startups particularly those in high-risk sectors will benefit from improved access to patient capital, which is essential for building deep technology products and business models.

Boost to Domestic Venture Capital

Local VC firms can leverage government support to attract co-investors, increasing the total pool of capital available for Indian startups.

Encouraging Technology Commercialisation

By focusing on innovation-driven sectors, the fund could accelerate technology commercialisation and spur global competitiveness for Indian startups.

Expert and Industry Reactions

Industry leaders have described the Cabinet’s approval as transformative for India’s startup ecosystem. Senior startup community figures see the ₹10,000 crore fund as a major step in supporting founders, especially in tier-2 and tier-3 cities that lack easy access to long-term capital.

Such support can help prevent early-stage business ideas from failing due to a lack of financing – a common challenge for first-time founders and deep-tech innovators.

What This Means for the Indian Economy

The government’s backing of FoF 2.0 is expected to yield benefits beyond the startup landscape, including:

- Creation of high-quality jobs

- Growth in technological exports

- Increased innovation across key sectors

- Strengthened global positioning in emerging technologies

A strong startup ecosystem contributes significantly to economic resilience and competitive advantage on the global stage.

Looking Ahead

With the startup ecosystem maturing rapidly, the new Fund of Funds 2.0 is poised to play a key role in India’s innovation journey.

The scheme’s success will depend on effective capital deployment, strong governance, and co-investment from private sources. However, the Cabinet approval reflects a strategic push to ensure startups – especially deep-tech ventures – have the financial backing needed to scale and succeed.

Conclusion

The Union Cabinet’s approval of the ₹10,000 crore Startup India Fund of Funds 2.0 signals a renewed focus on strengthening India’s startup ecosystem, particularly in deep-tech and innovation-driven sectors. By mobilising long-term capital, supporting venture capital networks, and encouraging inclusive investment across regions, the government has reinforced its commitment to building a world-class startup nation.

The initiative builds on the success of earlier efforts and expands India’s capacity to support founders with ambitious, high-impact visions – a vital step in realising the country’s potential as a global innovation hub by 2047.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Last Updated on Monday, February 16, 2026 10:31 am by Startup Newswire Team