RBI February 2026 Policy Tightens Digital Lending and Payment Rules: Key Changes for Borrowers, Fintechs and Banks

Central Bank Strengthens Oversight of Digital Loans and Payment Systems

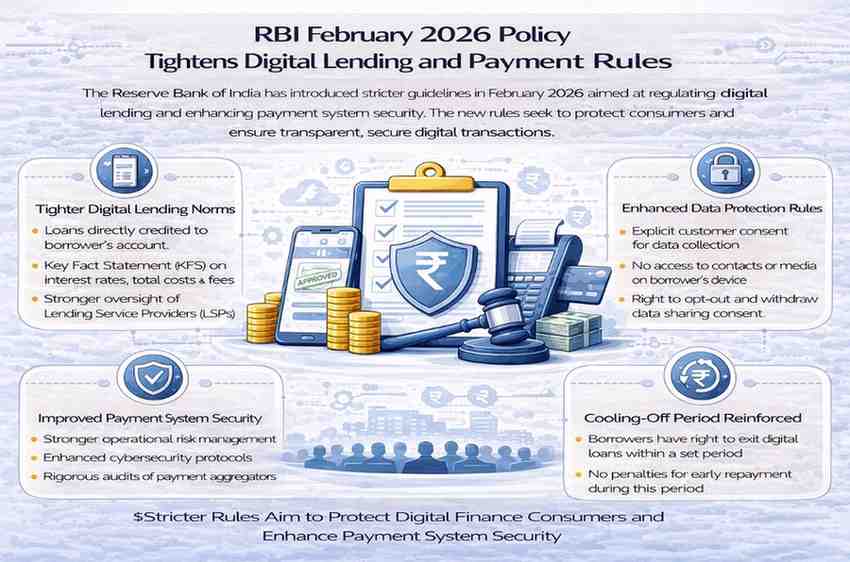

The Reserve Bank of India (RBI) has announced tighter rules on digital lending and payment systems as part of its February 2026 policy update, reinforcing consumer protection and regulatory oversight in India’s fast-growing digital finance sector.

The move comes amid rising digital loan adoption, rapid growth in UPI transactions, and increasing scrutiny of fintech practices. The RBI’s latest policy decisions aim to improve transparency, reduce risks, and strengthen accountability across digital platforms.

For borrowers, fintech firms, NBFCs and banks, the updated framework introduces stricter compliance standards and clearer operational guidelines.

Why the February 2026 RBI Policy Matters

India’s digital economy has expanded at record speed. From instant personal loans to QR-based payments, millions rely on digital financial services daily.

However, rapid growth has also brought challenges:

- Complaints about hidden loan charges

- Misuse of customer data

- Aggressive recovery practices

- Operational risks in payment systems

The RBI’s February 2026 policy signals a clear message: digital innovation must operate within strong consumer protection norms.

Stricter Digital Lending Compliance

The RBI has reinforced earlier digital lending directions issued in previous years.

1. Direct Disbursal and Repayment Rules Reaffirmed

Regulated entities must ensure:

- Loan amounts are credited directly to the borrower’s bank account.

- Repayments are made directly to the lender’s bank account.

Use of third-party pass-through accounts remains restricted, except in permitted cases.

This step improves transparency and reduces the risk of fund diversion.

2. Mandatory Key Fact Statement (KFS)

Digital lenders must provide a clear Key Fact Statement (KFS) before loan execution.

The KFS must include:

- Interest rate

- Annual Percentage Rate (APR)

- Processing fees

- Penal charges

- Total loan cost

No undisclosed charges can be added later.

This ensures borrowers fully understand the cost of credit.

3. Stronger Oversight of Lending Service Providers (LSPs)

Banks and NBFCs partnering with fintech platforms must conduct enhanced due diligence.

The RBI clarified that:

- The regulated entity remains fully responsible for compliance.

- Outsourcing does not transfer regulatory accountability.

This closes gaps where digital apps operated without adequate oversight.

Data Privacy and Customer Consent Measures

The February 2026 policy reiterates that digital lenders:

- Must collect only necessary data.

- Require explicit customer consent.

- Cannot access mobile contacts or media files without legal basis.

Customers must also be allowed to withdraw consent.

Data misuse in digital lending has been a major area of concern in recent years. The RBI’s tighter supervision aims to address these issues.

Cooling-Off Period Strengthened

Borrowers continue to have the right to exit digital loans within a defined cooling-off period by paying:

- Principal amount

- Proportionate charges

No penalty can be imposed during this period.

This protects borrowers from falling into high-cost loans without adequate review.

Payment System Risk Controls Tightened

Beyond lending, the February 2026 policy also addresses payment system resilience.

India’s digital payments ecosystem led by UPI and other real-time systems processes billions of transactions monthly.

To manage systemic risk, the RBI has emphasized:

- Stronger operational risk management

- Enhanced cybersecurity protocols

- Regular system audits

- Incident reporting standards

Payment service providers must ensure robust infrastructure to prevent outages and fraud.

Focus on UPI and Payment Aggregators

The RBI has maintained close supervision over payment aggregators and UPI participants.

Payment aggregators must:

- Follow capital adequacy norms

- Maintain escrow accounts properly

- Ensure merchant onboarding compliance

The National Payments Corporation of India (NPCI) continues to operate UPI under RBI oversight.

The policy update reinforces operational discipline amid rising transaction volumes.

Impact on Fintech Companies

The tighter rules may increase compliance costs for fintech firms.

Companies will need to:

- Upgrade systems

- Strengthen governance structures

- Improve transparency

- Enhance data protection mechanisms

While some startups may find stricter norms challenging, stronger regulation can also increase investor confidence in the sector.

Clear regulatory standards provide long-term stability.

Implications for Banks and NBFCs

Banks and NBFCs offering digital loans must ensure:

- Board-approved digital lending policies

- Periodic audits of fintech partners

- Clear customer grievance redress systems

- Transparent disclosures

The RBI has emphasized accountability at the highest governance level.

This could lead to more cautious partnerships with digital platforms.

What Borrowers Should Know

For consumers, the February 2026 RBI policy strengthens protections.

Borrowers should:

- Check if the lender is RBI-regulated

- Read the Key Fact Statement carefully

- Verify total cost of the loan

- Use official grievance redress channels if needed

Greater transparency reduces the risk of financial stress caused by hidden costs.

Digital Finance Growth Continues

India remains one of the world’s fastest-growing digital payment markets.

Key drivers include:

- Smartphone adoption

- Government push for digital transactions

- Merchant QR code expansion

- Financial inclusion initiatives

The RBI’s tightening of rules does not slow growth. Instead, it aims to ensure that growth is safe and sustainable.

Regulatory Balance: Innovation and Protection

The RBI’s February 2026 stance reflects a broader global trend.

Central banks worldwide are grappling with:

- Digital credit expansion

- Fintech competition

- Cybersecurity risks

- Consumer data protection

India’s approach seeks to balance innovation with regulation.

The central bank has repeatedly emphasized that digital finance must not compromise customer safety.

Market Reaction and Industry Outlook

Industry observers view the policy update as a continuation of the RBI’s firm supervisory approach.

While fintech stocks and private players may face near-term adjustments, long-term benefits could include:

- Increased trust

- Lower systemic risk

- Better investor sentiment

- Reduced fraud incidents

Strong regulation often strengthens market credibility.

Looking Ahead

The RBI is expected to continue close monitoring of digital lending and payments.

Future focus areas may include:

- Artificial intelligence in credit scoring

- Cross-border digital payments

- Real-time fraud monitoring

- Strengthened cybersecurity norms

India’s digital finance ecosystem is evolving rapidly. Regulatory clarity will remain critical.

Conclusion

The RBI’s February 2026 policy tightening digital lending and payment rules marks an important step in strengthening India’s digital finance framework.

By reinforcing disclosure norms, tightening data protection rules, and enhancing payment system oversight, the central bank aims to protect consumers while maintaining innovation momentum.

For borrowers, fintech firms, banks and payment companies, the message is clear: transparency, compliance and customer protection are central to the future of digital finance in India.

As digital transactions continue to rise, strong regulatory foundations will ensure that India’s fintech growth remains stable, secure and globally competitive.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Last Updated on Monday, February 16, 2026 11:06 am by Startup Newswire Team