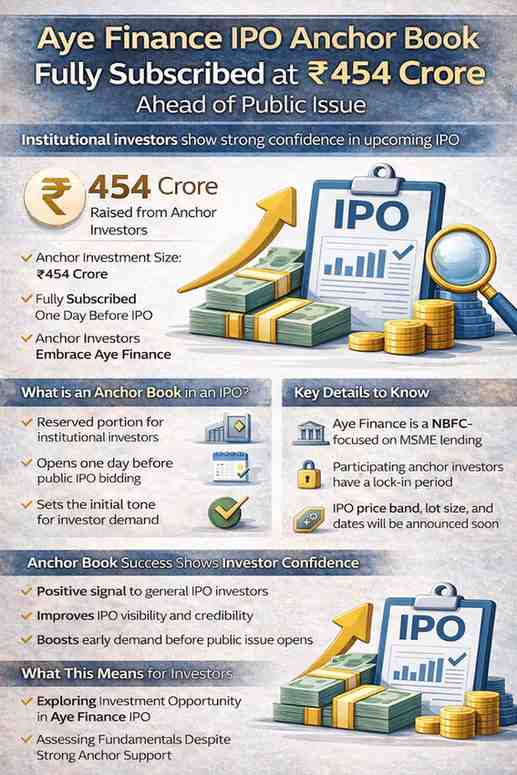

Aye Finance IPO Anchor Book Fully Subscribed at ₹454 Crore Ahead of Public Issue

The upcoming initial public offering (IPO) of Aye Finance has received a strong response from institutional investors. The company’s anchor book was fully subscribed at ₹454 crore, signaling solid demand before the IPO opens for public bidding.

The anchor round is often seen as an early indicator of investor confidence. A fully subscribed anchor book suggests positive sentiment around the company’s growth prospects and business model.

Here is a detailed look at what the anchor subscription means, how the IPO process works, and what retail investors should know.

Aye Finance IPO Anchor Book: Key Highlights

Aye Finance has raised ₹454 crore from anchor investors ahead of its IPO launch.

Key points include:

- Anchor book size: ₹454 crore

- Fully subscribed before public issue

- Participation from institutional investors

- Shares allotted ahead of IPO opening

The anchor book portion is reserved for large institutional investors. These include mutual funds, insurance companies, and foreign portfolio investors.

Strong anchor participation is often viewed as a positive signal for the broader IPO.

What Is an Anchor Book in an IPO?

An anchor book is a portion of an IPO reserved for institutional investors before the public subscription begins.

Key features of the anchor book:

- Open one day before IPO bidding

- Allotted to qualified institutional buyers (QIBs)

- Lock-in period for anchor investors

- Sets tone for public issue demand

When the anchor book is fully subscribed, it often improves investor confidence.

However, retail investors should evaluate the company’s fundamentals independently.

About Aye Finance

Aye Finance operates in the non-banking financial company (NBFC) segment.

The company focuses on providing loans to:

- Micro enterprises

- Small businesses

- Underserved borrowers

Its business model aims to serve small entrepreneurs who may not have easy access to traditional banking credit.

The company operates across multiple states and offers small-ticket loans tailored to local businesses.

Why the Anchor Subscription Matters

The ₹454 crore anchor book subscription reflects institutional interest.

Strong anchor participation can lead to:

- Higher visibility for the IPO

- Better subscription momentum

- Improved market perception

Institutional investors typically conduct detailed financial and risk analysis before investing.

Their participation may indicate confidence in the company’s growth story.

However, anchor subscription does not guarantee listing gains.

Aye Finance IPO: What to Expect

Following the anchor allocation, the IPO will open for public subscription.

Investors will be able to apply under:

- Retail category

- Qualified Institutional Buyers (QIBs)

- Non-Institutional Investors (NIIs)

Details such as price band, lot size, and subscription dates will determine final demand levels.

The IPO market has seen mixed trends recently, with some issues receiving strong response and others witnessing moderate interest.

India’s IPO Market in Focus

India’s primary market has been active over the past year.

Several companies across sectors such as:

- Financial services

- Technology

- Manufacturing

- Consumer brands

have tapped the market for capital.

Investor interest in IPOs often depends on:

- Company profitability

- Valuation

- Growth prospects

- Market sentiment

The strong anchor book subscription for Aye Finance adds to the momentum in the financial services segment.

NBFC Sector Outlook

Non-Banking Financial Companies (NBFCs) play an important role in India’s credit ecosystem.

They help:

- Small businesses access loans

- Bridge credit gaps

- Support rural and semi-urban markets

With the government focusing on financial inclusion, NBFCs have growth opportunities.

However, the sector also faces challenges such as:

- Regulatory compliance

- Credit risk

- Funding costs

Investors usually assess asset quality and loan book growth before investing.

Key Factors Investors Should Watch

Before applying for the Aye Finance IPO, investors may consider:

- Revenue growth trends

- Profitability metrics

- Non-performing assets (NPAs)

- Loan book expansion

- Capital adequacy

Valuation compared to listed peers is also important.

Retail investors should read the company’s draft red herring prospectus (DRHP) for complete details.

Market Sentiment Around Financial Services IPOs

Financial services companies often attract strong investor interest.

This is because:

- Credit demand in India is rising

- MSME lending is expanding

- Financial inclusion initiatives are growing

However, market conditions at the time of listing can influence performance.

Strong anchor participation helps build early momentum but does not eliminate risk.

What Happens After Anchor Allocation

After the anchor book allocation:

- IPO opens for public bidding

- Investors apply within the price band

- Shares are allotted based on subscription levels

- Listing takes place on stock exchanges

The performance on listing day depends on subscription demand and broader market conditions.

Risks to Consider

While the anchor book is fully subscribed, investors should remain cautious.

Potential risks include:

- Economic slowdown affecting small borrowers

- Rising interest rates

- Regulatory changes

- Competitive pressure

Small business lending carries higher credit risk compared to large corporate lending.

Investors should align decisions with their risk appetite.

How Retail Investors Can Approach the IPO

Retail investors should avoid applying solely based on anchor subscription headlines.

Steps to consider:

- Study financial statements

- Compare with listed NBFC peers

- Assess valuation metrics

- Diversify investments

IPO investments carry market risk, and listing gains are not guaranteed.

Long-term performance depends on business fundamentals.

Conclusion

The Aye Finance IPO anchor book has been fully subscribed at ₹454 crore, indicating strong institutional demand ahead of the public issue.

The company, operating in the NBFC sector, focuses on lending to micro and small enterprises.

While the strong anchor response boosts confidence, investors should carefully evaluate financial metrics and market conditions before applying.

As the IPO opens to the public, subscription levels and broader market sentiment will determine the final outcome.

For now, the fully subscribed anchor book signals positive early momentum in Aye Finance’s journey to the stock market.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Financial Disclaimer: Markets and investment-related products are subject to risks and fluctuations. Readers should conduct their own research and consider consulting a qualified financial advisor before making any investment decisions.

Last Updated on Wednesday, February 11, 2026 10:35 am by Startup Newswire Team