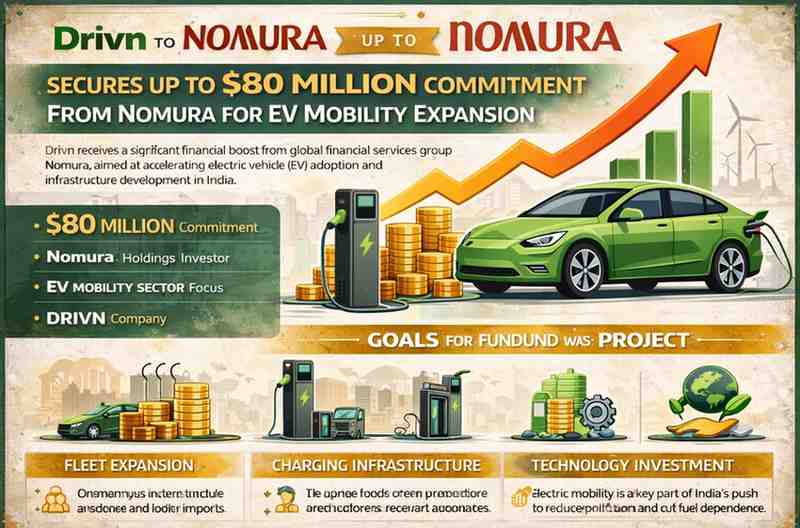

Drivn Secures Up to $80 Million Commitment from Nomura to Accelerate EV Mobility Expansion

Why This Funding Deal Matters for India’s EV Sector

India’s electric vehicle ecosystem received a major boost as Drivn secured a commitment of up to $80 million from Nomura Holdings to support its EV mobility expansion.

The deal signals growing global investor confidence in India’s electric mobility market. With EV adoption rising across cities, access to large capital commitments is crucial for scaling fleets, building infrastructure, and improving technology platforms.

For India, this funding development comes at a time when the country is pushing for faster EV adoption to reduce emissions and fuel imports.

Here is a detailed look at what the $80 million commitment means for Drivn, the EV sector, and India’s clean mobility goals.

Key Details of the $80 Million Commitment

- Funding Size: Up to $80 million

- Investor: Nomura Holdings

- Sector: Electric vehicle mobility

- Purpose: Fleet expansion, infrastructure growth, technology investment

The phrase “up to $80 million” suggests that the capital may be deployed in phases based on business milestones and expansion targets.

This structure is common in growth-stage funding, especially in capital-intensive sectors like EV mobility.

Who Is Drivn?

Drivn operates in the electric mobility space, focusing on building EV-based transportation solutions.

Its business model typically includes:

- Electric fleet deployment

- EV asset financing or leasing

- Charging infrastructure support

- Technology-driven fleet management

The company aims to support businesses and fleet operators transitioning from traditional fuel vehicles to electric alternatives.

As demand for electric vehicles grows in India, fleet-based EV solutions are gaining traction.

Nomura’s Strategic Interest in EV Mobility

Nomura is a global financial services group with investments across sectors.

Its commitment to Drivn reflects broader global interest in:

- Sustainable mobility

- Green infrastructure

- Climate-focused investments

Institutional investors are increasingly directing capital toward clean energy and EV sectors.

India, as one of the fastest-growing mobility markets, offers strong long-term potential.

How the Funding Will Be Used

1. Fleet Expansion

One of the key priorities is expanding the electric vehicle fleet.

Fleet growth may include:

- Electric two-wheelers

- Electric three-wheelers

- Electric commercial vehicles

Fleet scale is critical to achieving operational efficiency and improving margins.

2. Charging Infrastructure Development

EV adoption depends heavily on charging availability.

The funding could support:

- Fast-charging stations

- Urban charging hubs

- Partnerships with infrastructure providers

Improved charging networks help reduce range anxiety among users.

3. Technology and Platform Enhancement

EV companies rely on data and software for:

- Route optimisation

- Battery performance tracking

- Predictive maintenance

- Fleet utilisation monitoring

Investment in technology improves cost control and service quality.

India’s EV Market: A Rapid Growth Story

India’s electric mobility sector has grown steadily over the past few years.

Key drivers include:

- Government incentives

- Rising fuel prices

- Corporate sustainability goals

- Urban pollution concerns

Electric two-wheelers and three-wheelers have seen faster adoption compared to passenger cars.

Commercial fleets are now becoming a major growth segment.

Government Support and Policy Push

India has introduced several measures to promote EV adoption.

These include:

- Incentive schemes for EV buyers

- Support for battery manufacturing

- Production-linked incentives for advanced automotive technology

State governments are also offering benefits such as:

- Road tax exemptions

- Registration fee waivers

- Charging infrastructure support

Such policies make India an attractive market for EV investment.

Why Global Capital Is Flowing into Indian EV Startups

International investors are looking at India for several reasons:

- Large population base

- Growing urban mobility needs

- Government policy stability

- Expanding digital ecosystem

India’s transition to electric mobility presents long-term growth opportunities.

Capital-intensive sectors like EV fleets require structured financing models, which global institutions can support.

Challenges in EV Expansion

Despite strong momentum, challenges remain.

High Upfront Costs

Electric vehicles often require higher upfront investment compared to traditional vehicles.

Fleet operators need access to affordable financing.

Battery Supply Chain

Battery manufacturing and sourcing remain key concerns.

India is working toward local battery production, but imports still play a role.

Charging Infrastructure Gaps

While urban centres are seeing improvement, charging access in smaller cities remains limited.

Addressing these gaps will be critical for nationwide expansion.

Impact on India’s Climate Goals

India has set ambitious climate targets.

Electric mobility plays a central role in:

- Reducing urban air pollution

- Cutting fuel imports

- Lowering carbon emissions

Funding deals like this accelerate the transition to cleaner transport systems.

Fleet electrification, especially in commercial vehicles, can significantly reduce emissions.

Competitive Landscape in EV Mobility

India’s EV space has become increasingly competitive.

Players operate across:

- Vehicle manufacturing

- Battery swapping

- Charging infrastructure

- Fleet leasing

Drivn’s ability to secure up to $80 million strengthens its competitive position.

Access to structured funding helps companies scale faster and negotiate better partnerships.

Enterprise and B2B Opportunity

Much of India’s EV growth is now coming from B2B segments.

Corporate clients are adopting EV fleets for:

- Last-mile delivery

- Employee transportation

- Logistics operations

Companies are under pressure to meet sustainability goals.

Electric fleets offer both environmental and long-term cost benefits.

What This Means for Indian Consumers

While the deal primarily focuses on fleet expansion, consumers may benefit indirectly.

Greater EV adoption can lead to:

- Better charging networks

- Lower long-term vehicle costs

- Improved availability of EV options

As infrastructure improves, confidence in electric vehicles increases.

Future Outlook

The next few years will be crucial for India’s electric mobility growth.

Key factors to watch include:

- Speed of infrastructure rollout

- Battery cost reduction

- Regulatory stability

- Fleet profitability

If capital deployment is managed effectively, Drivn could become a significant player in India’s EV ecosystem.

Final Word

Drivn securing a commitment of up to $80 million from Nomura marks a significant milestone for India’s EV mobility sector.

The deal reflects:

- Growing investor confidence

- Strong policy support

- Rising demand for clean transport solutions

As India moves toward sustainable mobility, structured global investments will play a vital role.

The success of such funding partnerships will shape how quickly electric mobility becomes mainstream across the country.

For India’s EV ecosystem, this development signals both opportunity and acceleration.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Last Updated on Thursday, February 12, 2026 6:07 am by Startup Newswire Team