Mandatory FIU Registration for DeFi Startups: A Step-by-Step Compliance Guide for Indian Founders

India’s decentralized finance ecosystem is entering a decisive regulatory phase. What was once a loosely governed frontier of innovation is now being firmly brought under the country’s anti–money laundering and financial surveillance framework. For founders building DeFi platforms that touch Indian users, mandatory registration with the Financial Intelligence Unit of India has become not just a legal formality but a defining requirement for survival and scale.

The Financial Intelligence Unit–India, operating under the Ministry of Finance, is the nodal agency responsible for tracking, analysing and preventing financial crimes such as money laundering and terror financing. Under the Prevention of Money Laundering Act, entities classified as “reporting entities” are required to maintain transaction records, conduct customer due diligence and report suspicious activities. In a significant regulatory expansion, virtual digital asset service providers were formally brought under this framework, effectively extending FIU oversight to crypto platforms and, by implication, a wide range of DeFi businesses.

For Indian founders, the most critical shift lies in the regulator’s activity-based approach. Registration requirements are no longer determined solely by whether a company is incorporated in India. Instead, the decisive factor is whether a platform provides services to Indian users or facilitates transactions connected to India. DeFi startups that enable token swaps, digital asset transfers, custody, liquidity provision, or any financial service involving virtual digital assets can fall within FIU’s scope if their product has a clear operational interface, a founding team, or governance mechanisms that influence user activity. The argument that a protocol is “decentralized” offers limited protection when regulators can identify responsible persons or operational control points.

The rationale behind mandatory FIU registration is rooted in the government’s growing concern over the misuse of digital assets for illicit finance. Regulators argue that anonymity, cross-border reach and the speed of blockchain transactions make DeFi particularly vulnerable to abuse. By placing these platforms under the same AML and counter-terror financing regime as traditional financial institutions, authorities aim to close regulatory gaps without stifling innovation entirely.

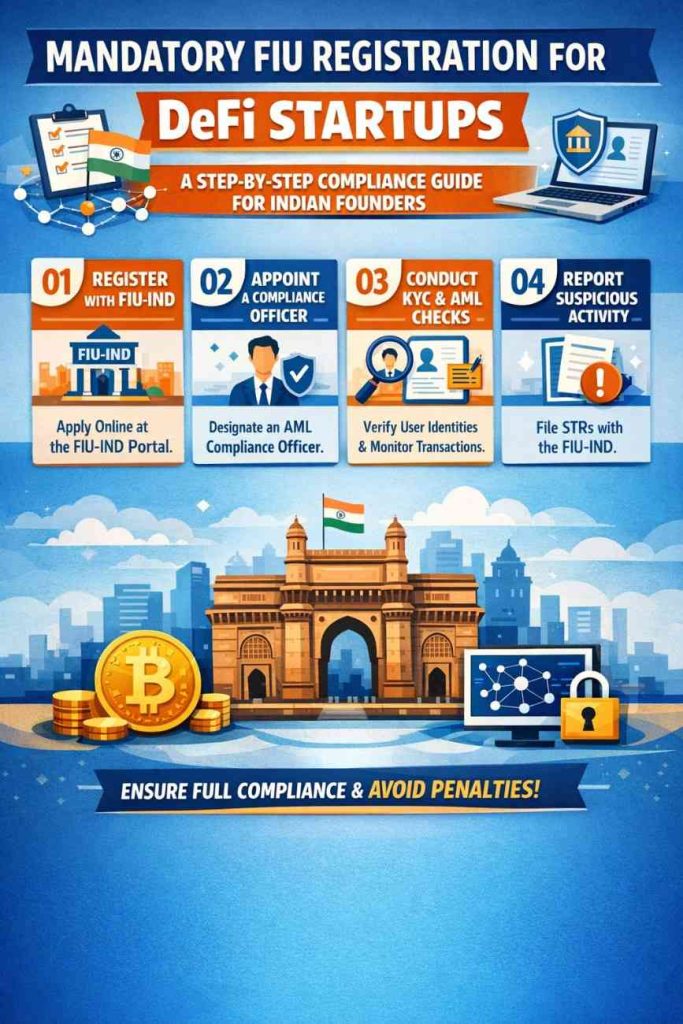

For founders, the compliance journey typically begins with formalizing the business structure. While some DeFi projects operate through foundations or offshore entities, Indian regulators increasingly expect clarity on who is accountable for compliance. Establishing a legally identifiable entity and defining governance roles is often the first practical step toward FIU registration, even if the core protocol remains open-source.

The next and most resource-intensive phase involves building a comprehensive anti–money laundering framework. FIU expects startups to demonstrate how they identify users, assess risk, monitor transactions and flag suspicious behaviour. This includes documented KYC and customer due diligence procedures, internal controls for enhanced due diligence in high-risk cases, mechanisms for ongoing monitoring and clearly defined escalation processes. Even DeFi platforms that rely on non-custodial models are being pushed to show how they mitigate financial crime risks at the interface level, such as through frontend controls or compliance-aware integrations.

Regulatory accountability is further reinforced through the appointment of senior compliance personnel. Startups are required to designate a director-level individual responsible for overall compliance and a principal officer tasked with day-to-day AML operations. These roles are not symbolic. FIU places personal responsibility on these officers, making them answerable for failures in reporting or compliance lapses.

Technology readiness is another critical pillar of registration. Founders must demonstrate that their systems can generate audit trails, store transaction data securely and support timely reporting to FIU when required. For many early-stage DeFi startups, this has meant partnering with compliance technology providers or redesigning parts of their architecture to meet regulatory expectations. Cybersecurity controls and data integrity have also become key areas of scrutiny, reflecting the regulator’s concern about systemic risk.

Once these foundations are in place, the formal registration process is initiated through FIU’s online reporting entity portal. Applications require extensive documentation, ranging from corporate records and compliance manuals to technical explanations of how the platform operates. The review process is rarely instantaneous. Regulators often seek clarifications, request additional disclosures or ask for demonstrations of compliance systems before granting formal recognition as a reporting entity.

Importantly, registration does not mark the end of regulatory obligations. Ongoing compliance is where many startups face their toughest challenges. Registered entities are expected to continuously monitor transactions, file suspicious transaction reports within prescribed timelines, retain records for several years and update their compliance frameworks as regulations evolve. Internal audits and staff training are increasingly viewed as essential, even for technology-driven teams with minimal human intervention in transactions.

The consequences of ignoring FIU registration are no longer theoretical. Indian authorities have already issued notices, imposed penalties and restricted access to non-compliant digital asset platforms, including those based overseas. For DeFi startups, non-registration can lead to loss of market access, banking difficulties, reputational damage and heightened legal risk for founders and senior management.

Despite the compliance burden, many industry observers argue that FIU registration may ultimately strengthen India’s DeFi ecosystem. In a market where regulatory uncertainty has often deterred institutional capital, clear compliance signals can improve investor confidence and enable responsible innovation. Founders who treat compliance as core infrastructure rather than an afterthought are better positioned to build scalable, trusted platforms in a tightening regulatory environment.

As India moves toward deeper oversight of digital finance, mandatory FIU registration represents a clear message from policymakers: DeFi innovation is welcome, but only within a framework that safeguards financial integrity. For Indian founders, adapting early may not just be about avoiding penalties—it may be the key differentiator between short-lived experimentation and long-term success in the country’s evolving Web3 economy.

Also Read : https://startupupdates.in/why-msmes-are-warning-of-a-compliance-crunch-ahead-of-the-2026-budget/

Add startupnewswire.in as preferred source on google – Click Here

Last Updated on Thursday, January 29, 2026 7:48 am by Startup Newswire Team