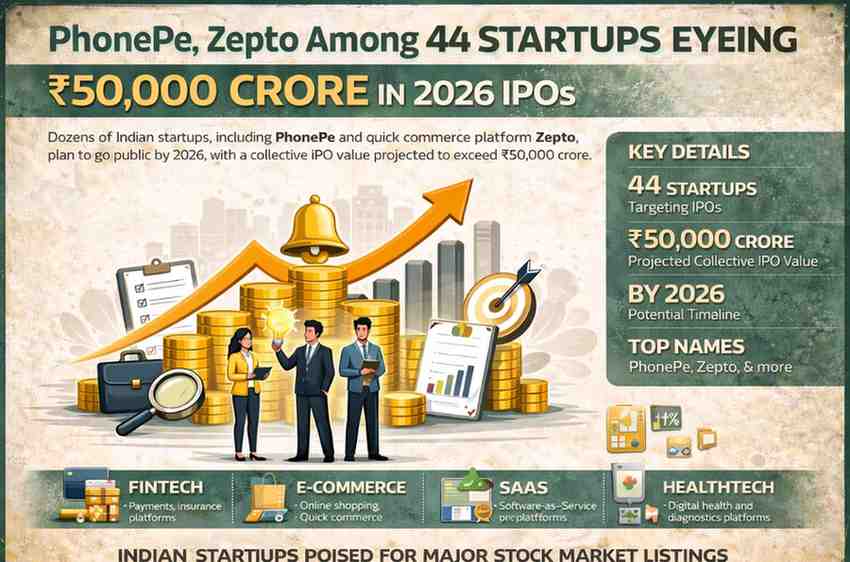

PhonePe, Zepto Among 44 Indian Startups Planning 2026 IPOs Worth ₹50,000 Crore

Why 2026 Could Be a Landmark Year for Indian Startup IPOs

India’s startup ecosystem is preparing for one of its biggest public listing waves yet. Around 44 venture-backed startups, including fintech major PhonePe and quick commerce platform Zepto, are reportedly exploring stock market listings in 2026.

Together, these companies could raise and unlock a combined market value of around ₹50,000 crore through initial public offerings (IPOs).

This expected IPO pipeline signals renewed confidence in India’s public markets after a period of cautious investor sentiment. For retail investors, founders, and global funds, 2026 may become a turning point for Indian tech listings.

Here is a detailed breakdown of what this IPO wave means, which sectors are leading, and why it matters now.

The Big Numbers at a Glance

- 44 startups planning or preparing for IPOs

- Estimated total value: ₹50,000 crore

- Expected timeline: Calendar year 2026

- Key names: PhonePe, Zepto and several high-growth startups

While not all companies have formally filed draft papers, market buzz suggests strong preparation activity behind the scenes.

Why Startups Are Choosing 2026 for IPOs

Several factors are influencing the timing.

1. Improving Market Sentiment

India’s equity markets have shown resilience in recent years. Benchmark indices have remained strong, and retail participation has increased significantly.

Companies prefer to list when:

- Market liquidity is high

- Investor appetite for growth stocks improves

- Valuations are stable

2026 could offer a favourable window if current trends continue.

2. Profitability Push After Funding Slowdown

After the funding slowdown of 2022–2024, startups shifted focus toward:

- Cost discipline

- Improved margins

- Sustainable growth

Many late-stage startups are now closer to profitability, making them better candidates for public markets.

3. Investor Exit Pressure

Venture capital and private equity investors seek liquidity events.

IPOs provide:

- Partial exits

- Valuation benchmarks

- Capital for future growth

With multiple funds nearing the end of their investment cycles, public listings offer a structured exit route.

Sector-Wise Breakdown: Who Is Leading the IPO Race?

Fintech

Fintech companies are expected to lead the IPO pipeline.

Players like PhonePe operate in:

- Digital payments

- Insurance distribution

- Lending platforms

- Financial services technology

India’s digital payments ecosystem continues to expand, supported by UPI adoption and financial inclusion.

Fintech remains one of the most attractive segments for public investors.

Quick Commerce and E-Commerce

Zepto represents the quick commerce segment, which focuses on ultra-fast deliveries.

Despite intense competition, the sector has seen:

- Strong urban demand

- Improved unit economics

- Operational efficiency gains

Investors will closely watch profitability metrics before IPO approvals.

SaaS and Enterprise Technology

Software-as-a-Service (SaaS) startups are also exploring listings.

These companies often benefit from:

- Recurring revenue models

- Global client base

- Higher gross margins

India’s SaaS ecosystem has gained global recognition in recent years.

Healthtech and Edtech

Select healthcare and education technology startups are also evaluating IPO readiness.

However, public market investors are now more selective, focusing on companies with strong fundamentals.

How ₹50,000 Crore Could Impact the Market

A combined IPO value of ₹50,000 crore would be significant.

Such capital inflows could:

- Boost stock market liquidity

- Expand the technology sector representation on exchanges

- Increase retail investor exposure to new-age businesses

It would also strengthen India’s image as a mature startup ecosystem capable of producing public market-ready companies.

Lessons from Previous Startup IPOs

India has already witnessed multiple high-profile tech IPOs in recent years.

The outcomes have been mixed.

Some companies:

- Delivered strong post-listing performance

- Improved financial discipline

Others faced:

- High volatility

- Investor scrutiny over profitability

The upcoming IPO wave will likely reflect lessons learned from earlier listings.

Investors are now more cautious and focus heavily on earnings visibility.

What Retail Investors Should Watch

For retail investors, startup IPOs can be attractive but require careful evaluation.

Key factors to review include:

- Revenue growth trends

- Path to profitability

- Competitive position

- Corporate governance standards

Valuation discipline will be critical.

Not every IPO guarantees strong listing gains.

Regulatory and Compliance Readiness

Companies planning IPOs must meet strict regulatory requirements.

These include:

- Filing draft red herring prospectus (DRHP)

- Detailed financial disclosures

- Governance frameworks

- Risk factor transparency

The Securities and Exchange Board of India (SEBI) has tightened disclosure norms in recent years.

This increases investor protection but also raises compliance costs for startups.

Impact on India’s Startup Ecosystem

If 44 startups successfully list in 2026, the ripple effects could be large.

1. New Capital for Growth

Public listings allow companies to raise fresh funds for:

- Expansion

- Technology upgrades

- Acquisitions

2. Talent Wealth Creation

Employee stock options (ESOPs) convert into liquid wealth post listing.

This can create:

- New angel investors

- Increased startup funding circulation

3. Global Investor Confidence

Successful IPOs improve India’s standing among global institutional investors.

Foreign portfolio investors often look for scalable tech stories in emerging markets.

Risks That Could Affect the IPO Pipeline

Despite strong interest, risks remain.

Market Volatility

Global economic uncertainties, interest rate movements, and geopolitical risks can affect IPO timing.

Valuation Mismatch

Public market investors may not always agree with private market valuations.

Companies may need to adjust pricing expectations.

Profitability Pressure

The public market demands quarterly performance consistency.

Startups must be prepared for ongoing scrutiny.

Is 2026 the Year of India’s Tech IPO Comeback?

The expected IPO pipeline suggests momentum is building.

However, final outcomes will depend on:

- Market stability

- Company performance

- Investor demand

If even a majority of the 44 startups proceed successfully, 2026 could mark a new chapter for India’s startup-to-public journey.

What This Means for India’s Economy

Large IPO activity has broader economic benefits.

It can:

- Increase domestic capital market depth

- Encourage entrepreneurship

- Strengthen innovation ecosystems

- Create wealth across stakeholders

India’s startup ecosystem, once heavily dependent on private funding, is gradually integrating with public capital markets.

Final Word

The possibility of 44 startups, including PhonePe and Zepto, eyeing ₹50,000 crore worth of IPOs in 2026 signals strong momentum in India’s startup ecosystem.

After years of private capital-driven growth, the shift toward public markets reflects maturity and confidence.

For investors, 2026 could offer new opportunities in fintech, quick commerce, SaaS, and digital services.

For founders and employees, it represents the next phase of wealth creation and accountability.

If market conditions remain stable, India may witness one of its largest startup IPO waves yet.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Financial Disclaimer: Markets and investment-related products are subject to risks and fluctuations. Readers should conduct their own research and consider consulting a qualified financial advisor before making any investment decisions.

Last Updated on Thursday, February 12, 2026 6:41 am by Startup Newswire Team