Why Cross-Border M&A Is Becoming the Preferred Exit Strategy for Indian Deeptech Founders

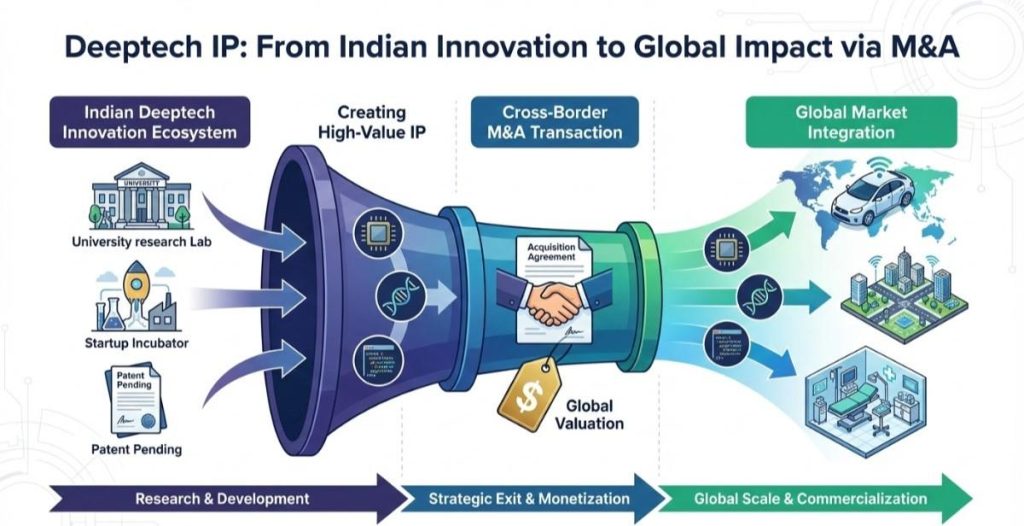

Cross-border mergers and acquisitions are rapidly emerging as the preferred exit strategy for Indian deeptech founders, marking a structural shift in how high-technology startups are monetising innovation and scaling globally. As India’s deeptech ecosystem matures across sectors such as artificial intelligence, space technology, semiconductors, advanced manufacturing, robotics and enterprise infrastructure, founders and investors are increasingly looking beyond domestic public listings and local buyouts. Instead, they are pursuing strategic international acquisitions that offer faster liquidity, global market access and long-term technology integration.

Over the past few years, India has built one of the world’s largest startup ecosystems by volume, but deeptech has followed a distinctly different trajectory compared to consumer internet and SaaS ventures. Deeptech startups are typically built on scientific research, patented intellectual property and complex engineering breakthroughs. Their development cycles are longer, capital requirements are higher, and commercialization timelines are less predictable. Unlike software platforms that can scale users quickly, deeptech products often require years of prototyping, certification, testing and regulatory clearance before reaching meaningful revenue. This difference is playing a decisive role in shaping exit preferences.

Market data from industry trackers shows that while IPOs surged among venture-backed technology startups after the first wave of Indian new-age listings, deeptech companies have participated far less in public offerings. Public markets tend to favor predictable revenue growth and short-to-medium term profitability visibility. Many deeptech companies, even when technologically strong, do not fit that profile at the stage when early investors seek exits. Cross-border acquisitions, by contrast, allow strategic buyers to value proprietary technology, patents and specialist teams even before large-scale revenue materializes.

At the same time, global corporations are under pressure to accelerate innovation cycles. Large technology, aerospace, defense, semiconductor and industrial automation firms are increasingly buying rather than building frontier capabilities. Acquiring deeptech startups offers them ready-made research teams, tested prototypes and defensible intellectual property. Indian startups have become attractive targets because they combine high technical talent density with relatively efficient capital use. India produces large numbers of engineers and researchers annually, and several government-supported innovation programs have expanded lab-to-market pathways in recent years. This has improved the technical depth and credibility of Indian deeptech ventures in the eyes of overseas buyers.

Cross-border deal activity involving Indian technology companies has reached record levels in recent periods, according to multiple transaction databases and advisory firms. Outbound acquisitions by Indian startups and inbound purchases of Indian tech assets by foreign companies have both increased in value and volume. Analysts attribute this to three simultaneous forces: the globalization of product markets, the normalization of remote technical collaboration, and the strategic urgency among multinational firms to secure emerging technologies early.

Currency dynamics and capital efficiency also play a role. When overseas acquirers with stronger balance sheets evaluate Indian deeptech firms, they often see favorable acquisition economics relative to similar assets in the United States or Europe. For Indian founders and venture investors, such deals can deliver meaningful returns without the prolonged capital raising cycles that deeptech scaling typically demands. In an environment where late-stage private funding has become more selective and valuation discipline has tightened, acquisition offers from global strategics can appear both safer and faster.

Regulatory evolution has further reduced friction in cross-border transactions. India has gradually refined its framework governing foreign investment, share swaps and cross-border mergers. Fast-track merger provisions and clearer rules around foreign ownership in many technology sectors have improved transaction certainty. While approvals are still required in sensitive sectors such as defense, space and certain categories of data infrastructure, deal pathways are more defined than they were a decade ago. Transaction lawyers report that cross-border structuring involving Indian entities has become more standardized, which lowers execution risk for both sides.

Another important factor is the nature of deeptech customers. Many deeptech products are built for global enterprise or government buyers rather than local mass markets. A startup developing chip design IP, satellite subsystems, industrial AI or advanced cybersecurity tools often finds that its largest potential customers are outside India. When revenue opportunity is inherently global, integration with an international acquirer can accelerate deployment across multiple geographies. Founders frequently view this not as a premature exit but as a scale multiplier that would be difficult to replicate independently.

Investor expectations are also influencing the shift. Deeptech investors, including specialized venture funds and corporate venture arms, typically underwrite longer development timelines but still operate within fund life cycles. Cross-border M&A provides a realistic liquidity route that aligns with those timelines. Several global venture funds active in India have publicly stated that strategic acquisitions are a natural outcome for deeptech portfolios, particularly where technology complements existing global platforms.

There is also a talent dimension to these transactions. Deeptech startups are built by tightly integrated teams of scientists, engineers and domain specialists whose collective expertise is hard to reproduce. International buyers often structure acquisitions specifically to retain Indian R&D centers and technical leadership, turning them into global innovation hubs within larger organizations. This model allows founders to continue building technology with greater resources while giving acquirers immediate access to proven teams.

The rise of cross-border M&A does not mean that domestic exits or IPOs will disappear for Indian deeptech companies. As the ecosystem deepens and more companies achieve commercial scale, public listings and large domestic mergers will remain viable paths. However, current evidence suggests that for a significant share of deeptech founders, especially those building highly specialized or infrastructure-level technologies, international strategic sales offer the most practical and value-maximizing exit.

The broader implication is that Indian deeptech is no longer viewed as peripheral experimentation but as a meaningful contributor to global innovation pipelines. When overseas corporations compete to acquire Indian frontier technology firms, it signals confidence in both the quality of research and the scalability of execution. For founders, cross-border M&A is increasingly not just an exit, but a gateway to global impact.

Also read : https://startupupdates.in/indian-saas-companies-turn-to-vertical-ai-to-counter-global-subscription-fatigue/

Add startupnewswire.in as preferred source on google – Click Here

Last Updated on Wednesday, February 4, 2026 2:37 pm by Startup Newswire Team