How to Leverage ONDC 2.0: A Strategic Growth Guide for Indian MSMEs and D2C Brands

In India’s fast-shifting digital economy, the second phase of the Open Network for Digital Commerce, widely referred to as ONDC 2.0, is quietly redefining how small businesses participate in online trade. At a time when Indian MSMEs and D2C brands are increasingly constrained by rising customer acquisition costs, high marketplace commissions, and limited control over data, ONDC 2.0 is positioning itself as a structural alternative rather than a competing marketplace.

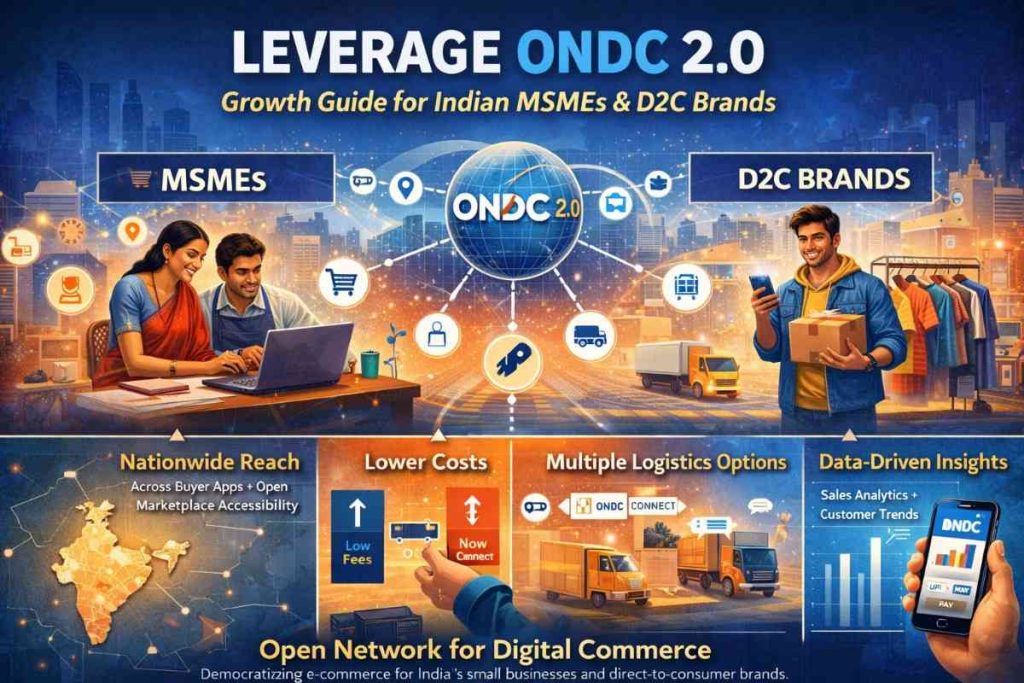

Unlike conventional e-commerce platforms that operate as closed ecosystems, ONDC is built as an open, interoperable network. It separates buyers, sellers, logistics providers, and payment systems into independent layers connected by a common protocol. This architectural shift is significant. It allows any seller to be discovered across multiple buyer applications without being locked into a single platform’s algorithm or commercial terms. For MSMEs and emerging D2C brands, this fundamentally alters the power balance in digital commerce.

ONDC 2.0 builds on the learnings of its initial rollout and places stronger emphasis on scalability, reliability, and seller experience. The upgraded network supports smoother catalog discovery, better order orchestration, improved logistics integration, and more consistent payment reconciliation. For small businesses that previously struggled with fragmented digital tools, this creates a unified yet flexible system to operate online.

The most immediate advantage for MSMEs lies in cost efficiency. Traditional marketplaces often extract a substantial portion of a seller’s margins through commissions, advertising spends, and visibility fees. ONDC’s open framework reduces these pressures by enabling direct price discovery and competition among service providers. Sellers retain greater control over pricing, promotions, and customer engagement, making profitability more sustainable in the long run.

For D2C brands, ONDC 2.0 offers a different but equally powerful value proposition. Many young brands have built strong products but remain dependent on a handful of large platforms for demand generation. ONDC allows these brands to diversify their digital presence without duplicating effort. A single catalog can reach customers across multiple buyer applications, expanding reach while reducing dependence on any one channel. This multi-app discoverability is emerging as a strategic hedge against rising platform risk.

Another critical dimension of ONDC 2.0 is geographic inclusion. Early participation trends indicate growing adoption from Tier II and Tier III cities, where local manufacturers, retailers, and service providers often lack the marketing budgets to compete on mainstream platforms. By standardizing discovery and reducing entry barriers, ONDC enables these businesses to access national demand while remaining rooted in local operations. This is particularly relevant for categories such as groceries, handicrafts, regional fashion, home essentials, and food services.

Data access is also proving to be a quiet but powerful shift. On closed marketplaces, sellers typically receive limited visibility into customer behavior. ONDC’s design allows sellers to access transaction-level insights that can inform inventory planning, regional demand analysis, and pricing strategies. For MSMEs that traditionally operated on intuition rather than analytics, this marks a transition toward data-driven decision-making.

Logistics integration under ONDC 2.0 has also matured. Sellers are no longer bound to a single logistics partner dictated by a platform. Instead, they can choose from multiple service providers based on cost, speed, and service quality. This flexibility is especially valuable for D2C brands shipping across diverse geographies, as it allows them to optimize fulfillment strategies and improve customer experience without inflating costs.

However, leveraging ONDC 2.0 effectively requires a shift in mindset. Success on the network is less about aggressive discounting and more about operational readiness. Accurate catalogs, reliable fulfillment, transparent policies, and responsive customer support play a decisive role in building trust across buyer applications. Brands that approach ONDC as a long-term distribution layer rather than a short-term sales channel are better positioned to extract value.

There are also challenges that businesses must navigate. As a decentralized network, ONDC does not offer the centralized dispute resolution or seller hand-holding that traditional platforms provide. This places greater responsibility on sellers to manage operations professionally. Digital literacy, process discipline, and internal systems become critical enablers. For many MSMEs, this transition will require gradual learning and ecosystem support.

Looking ahead, ONDC 2.0 is increasingly being viewed as digital public infrastructure for commerce, similar in spirit to how UPI transformed payments. Its success will not be measured by replacing existing marketplaces but by creating a parallel, open channel that restores choice and balance in the ecosystem. As more buyer applications, logistics firms, and payment providers integrate with the network, the value proposition for sellers is expected to strengthen further.

For Indian MSMEs and D2C brands, the strategic opportunity is clear. ONDC 2.0 offers a chance to scale digitally without surrendering margins, data, or autonomy. Those who invest early in building strong catalogs, efficient fulfillment, and brand trust within this open network are likely to gain a durable advantage in India’s next phase of e-commerce growth.

Add startupnewswire.in as preferred source on google – Click Here

Last Updated on Monday, February 2, 2026 9:06 am by Startup Newswire Team