Exponent Energy in Talks to Raise $25 Million Amid India’s EV Charging Boom

Why This Funding Move Matters Now

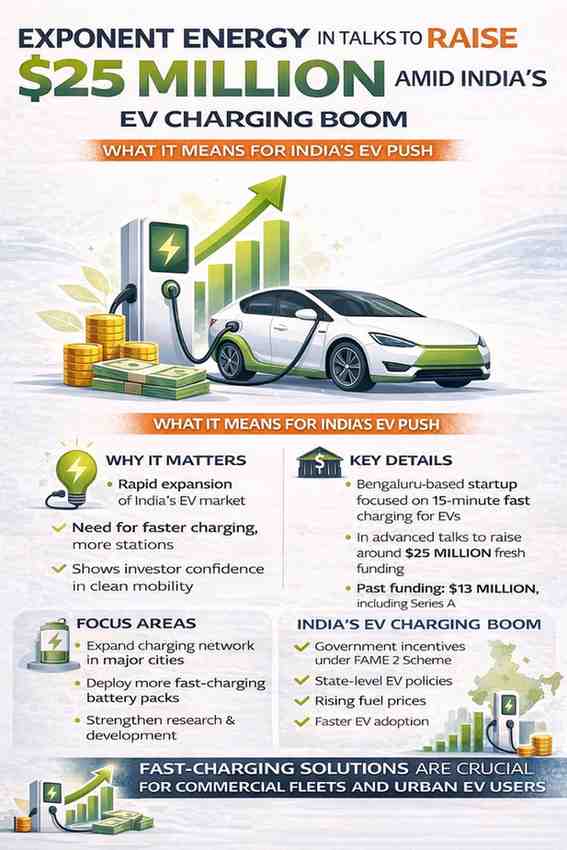

India’s electric vehicle (EV) sector is expanding at a rapid pace. Demand for faster charging, better battery systems and reliable public infrastructure is rising across cities.

In this backdrop, Bengaluru-based EV charging startup Exponent Energy is reportedly in talks to raise $25 million in a fresh funding round.

If finalised, the new capital could help the company scale its fast-charging network and strengthen its battery technology as competition in the EV charging space intensifies.

For India’s clean mobility push, this development signals growing investor interest in EV infrastructure — not just vehicle manufacturing.

About Exponent Energy

Exponent Energy is an Indian EV technology startup focused on solving one of the biggest problems in electric mobility — charging time.

The company builds:

- Rapid charging systems

- Battery management technology

- Integrated EV energy solutions

Its key focus has been enabling 15-minute fast charging for commercial electric vehicles, especially in the three-wheeler segment.

The startup operates mainly in urban markets and works closely with fleet operators.

Details of the $25 Million Funding Talks

According to reports, Exponent Energy is in discussions to raise around $25 million in a new funding round.

While the final structure of the deal, investor names and valuation details have not yet been officially disclosed, the capital is expected to be used for:

- Expanding charging infrastructure

- Scaling battery pack deployment

- Strengthening research and development

- Entering new cities

The round comes at a time when investor attention is shifting toward EV infrastructure players rather than only EV manufacturers.

India’s EV Charging Market Is Growing Fast

India’s EV ecosystem is undergoing a transformation.

Key drivers include:

- Government incentives under FAME schemes

- State-level EV policies

- Rising fuel prices

- Increasing environmental awareness

However, charging infrastructure remains a critical challenge.

Many potential EV buyers hesitate due to concerns about:

- Long charging times

- Limited charging stations

- Battery life

Companies like Exponent Energy are working to solve these issues.

Why Fast Charging Is a Game Changer

Charging speed is one of the biggest barriers to EV adoption.

Exponent Energy claims its technology enables significantly faster charging compared to traditional systems.

Faster charging can benefit:

- Fleet operators

- Delivery companies

- Auto-rickshaw drivers

- Urban mobility startups

For commercial vehicles, downtime directly affects income. Reducing charging time improves operational efficiency.

Focus on Commercial EV Segment

Exponent Energy has focused primarily on electric three-wheelers.

India is one of the world’s largest markets for three-wheelers, especially in cities.

Commercial EVs are attractive because:

- They operate on fixed routes

- Charging can be planned

- Fleet economics are predictable

Targeting fleet operators allows startups to scale faster than relying solely on individual EV owners.

Investor Interest in EV Infrastructure

In recent years, most funding in India’s EV sector has gone into:

- EV manufacturers

- Battery startups

- Mobility platforms

However, infrastructure startups are now gaining attention.

Investors recognise that without strong charging networks, EV adoption cannot accelerate.

A $25 million funding round, if completed, would give Exponent Energy additional runway to compete in this growing market.

Competitive Landscape in EV Charging

The EV charging space in India includes:

- Oil marketing companies

- Private charging startups

- Global charging technology providers

- Battery-swapping companies

Competition is increasing as demand rises.

Exponent Energy differentiates itself by offering an integrated approach combining:

- Battery packs

- Charging hardware

- Software management systems

Integrated systems can improve performance and reliability.

Government Push for EV Infrastructure

India’s central and state governments are encouraging EV charging deployment.

Incentives include:

- Capital subsidies

- Reduced electricity tariffs

- Policy support for public charging stations

Several states aim to increase the number of public charging points over the next few years.

The government’s broader clean energy goals are also aligned with EV adoption.

What the Funding Could Be Used For

If the $25 million round closes successfully, the capital could be deployed in the following areas:

1. Charging Network Expansion

More stations in cities such as:

- Bengaluru

- Delhi

- Mumbai

- Chennai

Urban expansion will improve accessibility for fleet operators.

2. Research and Development

Battery performance and charging safety are critical.

Investment in R&D can help improve:

- Battery lifespan

- Thermal management systems

- Charging efficiency

3. Partnerships with Fleet Operators

Strategic partnerships can drive faster deployment.

Large fleet operators offer predictable charging demand.

4. Talent Hiring

As EV technology grows more complex, startups need skilled engineers and energy specialists.

EV Charging: A Long-Term Opportunity

India aims to significantly increase EV penetration over the next decade.

However, adoption depends heavily on:

- Charging availability

- Charging speed

- Cost efficiency

Infrastructure players like Exponent Energy sit at the centre of this transition.

As more electric vehicles hit the road, demand for rapid charging systems is expected to grow.

Risks and Challenges

Despite strong momentum, the EV charging sector faces challenges:

- High capital expenditure

- Technology standardisation issues

- Grid load management

- Regulatory changes

Charging infrastructure requires significant upfront investment.

Returns may take time, especially in early-stage markets.

Why This Matters for India’s Clean Mobility Goals

India is pushing toward reduced carbon emissions and cleaner urban transport.

Electric mobility is a major part of that strategy.

Funding in EV charging startups signals confidence in:

- Sustainable transport

- Urban electrification

- Energy innovation

Exponent Energy’s potential funding round reflects growing maturity in India’s EV ecosystem.

Market Outlook for EV Startups

Over the past few years, India’s EV market has seen:

- Rising vehicle registrations

- Expansion of charging points

- Increasing private investment

As battery costs gradually decline and charging networks improve, adoption is expected to rise further.

Startups that build reliable infrastructure early may gain long-term advantage.

What Happens Next

The funding talks are still ongoing.

Key developments to watch include:

- Official announcement of investors

- Final deal size confirmation

- Valuation details

- Expansion plans

Investors and industry watchers will monitor how the capital is deployed.

Bottom Line

Exponent Energy’s reported talks to raise $25 million highlight strong investor interest in India’s EV charging sector.

As the country accelerates its clean mobility push, infrastructure startups are becoming central to the EV ecosystem.

Fast charging technology could play a major role in improving adoption among commercial fleet operators.

If the funding round is successfully completed, Exponent Energy may strengthen its position in one of India’s fastest-growing sectors.

The EV charging boom is not just about vehicles. It is about building the energy backbone that powers the future of mobility in India.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Financial Disclaimer: Markets and investment-related products are subject to risks and fluctuations. Readers should conduct their own research and consider consulting a qualified financial advisor before making any investment decisions.

Last Updated on Friday, February 13, 2026 11:29 am by Startup Newswire Team