Unicorn Zerodha Explores IPO Filing Amid SEBI Reforms

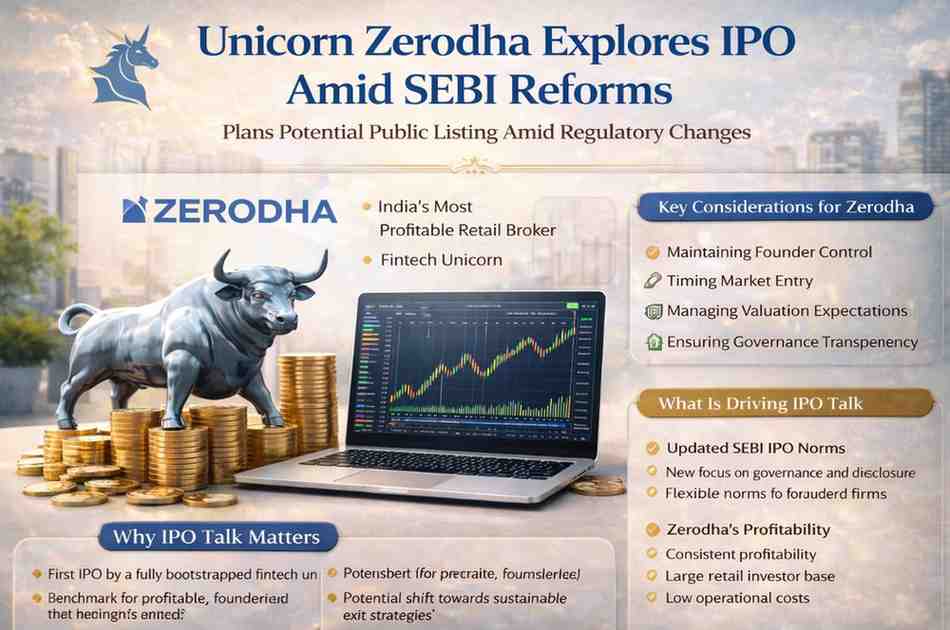

India’s most profitable fintech unicorn, Zerodha, is exploring the possibility of filing an initial public offering (IPO)as regulatory changes by the market watchdog reshape the public listing landscape. While no formal announcement has been made, the development has sparked strong interest across Dalal Street and the startup ecosystem.

The move comes at a time when Securities and Exchange Board of India (SEBI) has introduced and proposed reforms aimed at making IPO norms more flexible, transparent, and founder-friendly. For a company like Zerodha known for its bootstrapped model and strong profitability these changes could significantly influence listing decisions.

Why Zerodha’s IPO Plans Matter

Zerodha is not just another startup. It is:

- India’s largest retail stockbroker by active clients

- One of the few unicorns that is fully bootstrapped

- A rare example of a fintech firm with consistent profitability

Any move by Zerodha towards an IPO would:

- Set a benchmark for profit-led public listings

- Influence how other fintechs plan exits

- Test investor appetite for low-burn, founder-controlled companies

What Is Driving IPO Talk Around Zerodha

SEBI’s Changing IPO Rules

Over the past year, SEBI has focused on:

- Simplifying disclosure norms

- Improving clarity around promoter control

- Enhancing governance standards for new-age companies

These reforms aim to address concerns raised during earlier tech IPO waves, where volatility and post-listing performance drew criticism.

For companies like Zerodha, which have:

- Clean balance sheets

- No external venture capital pressure

- Transparent revenue models

the revised framework is seen as more aligned with long-term value creation.

Zerodha’s Business Model at a Glance

Zerodha operates on a discount brokerage model, offering:

- Zero brokerage on equity delivery

- Flat fees on intraday and derivatives trades

- A technology-first trading platform

Unlike many fintech peers, Zerodha:

- Does not rely heavily on advertising

- Has avoided aggressive expansion spending

- Focuses on profitability and cash reserves

This approach has allowed the company to remain independent of market funding cycles.

Profitability Sets Zerodha Apart

While many fintech startups continue to chase growth at high costs, Zerodha has consistently reported:

- Strong operating margins

- Stable revenue from retail trading

- Low customer acquisition costs

This financial discipline is often cited as a key reason why any IPO, if pursued, would be carefully timed rather than rushed.

Founder Control and IPO Timing

One of the biggest considerations for Zerodha’s leadership has historically been control.

An IPO would bring:

- Greater regulatory scrutiny

- Public shareholder expectations

- Quarterly performance pressure

SEBI’s recent emphasis on clear promoter roles and governance transparency may help founders retain influence while meeting public market norms. This balance is critical for companies that have grown without institutional investors.

How SEBI Reforms Are Changing the IPO Landscape

Focus on Governance, Not Just Growth

SEBI’s approach now stresses:

- Sustainable business models

- Realistic projections

- Strong internal controls

This shift aligns well with companies like Zerodha that prioritise long-term stability over rapid expansion.

Better Protection for Retail Investors

With a large retail participation base, SEBI’s reforms aim to:

- Improve disclosure quality

- Reduce information asymmetry

- Strengthen post-listing compliance

A Zerodha IPO under this framework would likely be positioned as a low-risk, fundamentals-driven offering.

What an IPO Could Mean for Investors

If Zerodha proceeds with an IPO, it could offer:

- Exposure to India’s growing retail investing base

- A profitable fintech business with minimal debt

- A contrast to cash-burning tech listings of the past

However, valuation expectations would remain a key factor, especially in a market that has become more cautious about tech stocks.

Impact on the Indian Fintech Ecosystem

Zerodha’s decision will be closely watched by:

- Fintech startups considering public markets

- Founders weighing profitability versus growth

- Policymakers tracking capital market reforms

A successful listing could:

- Encourage more bootstrapped firms to consider IPOs

- Shift focus back to sustainable business models

- Reinforce India’s reputation for mature fintech innovation

No Official Timeline Yet

It is important to note that:

- Zerodha has not filed draft IPO papers

- There is no confirmed listing date

- Any move will depend on market conditions and regulatory clarity

Industry observers believe the company will act only when it sees long-term value for users, founders, and future shareholders.

Market Context: IPO Sentiment in 2026

India’s IPO market has shown:

- Improved investor selectivity

- Preference for profitable or near-profitable firms

- Lower tolerance for aggressive forecasts

In this environment, a Zerodha IPO if it happens would likely be positioned as a quality-driven offering rather than a hype-led one.

Final Word

Zerodha exploring an IPO amid SEBI reforms signals a possible shift in India’s fintech listing narrative. While no decision is final, the combination of regulatory easing, strong fundamentals, and a maturing capital market makes the discussion timely and significant.

For investors, founders, and policymakers alike, Zerodha’s next move could redefine how India’s most successful startups approach public markets.

Financial Disclaimer

Markets and investment-related products are subject to risks and fluctuations. Readers are advised to conduct their own research and consult a qualified financial advisor before making investment decisions.

Last Updated on Friday, February 6, 2026 12:10 pm by Startup Newswire Team