Varaha Closes $20 Million Series B Tranche Led by WestBridge to Accelerate Climate Tech Expansion

Why Varaha’s $20M Series B Funding Matters for India’s Climate Tech Sector

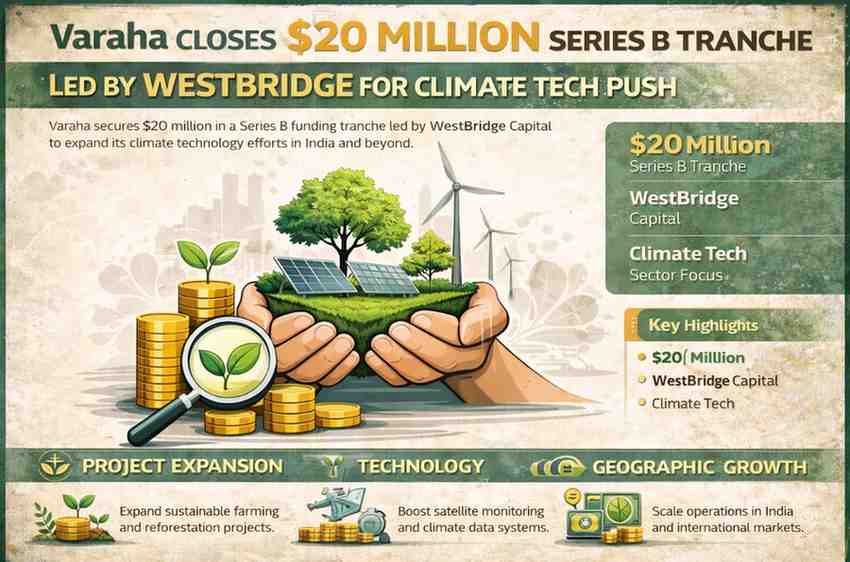

India’s climate technology ecosystem received a fresh boost as Varaha announced the closing of a $20 million Series B tranche, led by WestBridge Capital.

The funding comes at a time when climate tech startups are gaining global attention for building solutions that address carbon reduction, sustainable agriculture, and environmental resilience.

For India, which has committed to ambitious climate targets, investment in climate-focused startups is critical. This new capital is expected to help Varaha expand its operations, strengthen technology platforms, and scale its carbon market initiatives.

Here is a detailed look at what the $20 million tranche means for Varaha, investors, and India’s climate innovation ecosystem.

Key Highlights of the Funding Deal

- Amount Raised: $20 million

- Funding Round: Series B tranche

- Lead Investor: WestBridge Capital

- Sector Focus: Climate technology

A “tranche” in funding typically means part of a larger round. This indicates that Varaha may continue to raise additional capital under its Series B structure.

The funding will support growth initiatives and long-term climate projects.

What Does Varaha Do?

Varaha operates in the climate technology space, focusing on:

- Carbon credit generation

- Sustainable agriculture projects

- Nature-based climate solutions

- Climate data and monitoring

The company works with farmers, businesses, and institutions to create measurable environmental impact.

Its model often involves helping agricultural communities adopt sustainable practices while generating verified carbon credits.

Understanding Carbon Credits and Climate Tech

Carbon credits are part of global efforts to reduce greenhouse gas emissions.

Companies that reduce or offset emissions can generate carbon credits, which may be sold to businesses seeking to offset their carbon footprint.

Climate tech startups like Varaha aim to:

- Improve measurement accuracy

- Increase transparency in carbon markets

- Ensure verified climate impact

As climate regulations tighten globally, demand for reliable carbon credits is rising.

How the $20 Million Will Be Used

1. Expanding Climate Projects

Varaha is expected to use the funding to expand:

- Sustainable farming programs

- Reforestation initiatives

- Soil carbon projects

Scaling such projects requires technology, partnerships, and field operations.

2. Strengthening Technology Platforms

Climate data tracking is central to carbon credit generation.

Investment may support:

- Satellite monitoring tools

- Data analytics systems

- Verification technology

Accurate measurement ensures credibility in carbon markets.

3. Geographic Expansion

With fresh capital, Varaha may expand operations into:

- New Indian states

- International markets

Global demand for carbon credits offers growth opportunities beyond India.

Why Investors Are Betting on Climate Tech

Climate tech is becoming a major global investment theme.

Key reasons include:

- Growing environmental regulations

- Corporate net-zero commitments

- Investor focus on ESG (Environmental, Social, Governance) goals

Climate-focused funds are increasing capital allocation toward startups offering measurable environmental solutions.

India, with its large agricultural base, presents strong opportunities for nature-based climate solutions.

Role of WestBridge Capital

WestBridge Capital has invested across sectors including technology and growth-stage companies.

Its participation in Varaha’s Series B tranche signals confidence in:

- Climate-focused business models

- Carbon market growth potential

- Scalable sustainability solutions

Institutional investors are increasingly entering the climate tech space.

India’s Climate Commitments and Startup Opportunity

India has pledged to reduce emissions intensity and expand renewable energy capacity.

Achieving these goals requires:

- Clean energy expansion

- Sustainable land use practices

- Efficient carbon markets

Climate tech startups can support government efforts by building scalable and transparent systems.

Investment in this sector aligns with both environmental and economic objectives.

Challenges in the Carbon Market

Despite growth, carbon markets face challenges.

1. Verification and Transparency

Accurate carbon measurement is critical.

Startups must ensure that emission reductions are real and verifiable.

2. Regulatory Frameworks

Carbon trading rules vary by country.

Clear policy support is essential for long-term stability.

3. Market Volatility

Carbon credit prices can fluctuate based on global demand and regulation.

Companies must manage financial risk effectively.

Impact on Farmers and Rural Communities

Climate projects often involve collaboration with farmers.

Sustainable practices can include:

- Improved soil management

- Reduced chemical use

- Agroforestry initiatives

If implemented effectively, such projects can:

- Increase farmer income

- Improve soil health

- Enhance climate resilience

This creates both environmental and social benefits.

Climate Tech and India’s Startup Ecosystem

India’s startup ecosystem is evolving beyond consumer apps and fintech.

Sectors gaining attention include:

- Climate tech

- Deep tech

- Enterprise SaaS

- Healthtech

Varaha’s funding highlights a shift toward impact-driven innovation.

Climate startups require patient capital due to long project cycles.

Series B funding suggests investor confidence in Varaha’s growth trajectory.

Global Context: Climate Investment Surge

Globally, climate-focused investments have increased as companies commit to:

- Net-zero emissions targets

- Sustainable supply chains

- ESG reporting standards

Carbon markets are expected to grow as regulatory frameworks mature.

Startups that combine technology with environmental science are well-positioned.

What This Means for Indian Businesses

Indian companies seeking to offset emissions may benefit from:

- Improved access to verified carbon credits

- Local climate solutions

- Transparent carbon accounting tools

Domestic climate tech players can reduce reliance on international markets.

Future Outlook for Varaha

With $20 million in fresh capital, Varaha’s next phase may focus on:

- Scaling partnerships

- Expanding carbon credit portfolios

- Improving monitoring technology

- Strengthening investor relations

Success will depend on execution, regulatory alignment, and market demand.

Final Word

Varaha closing a $20 million Series B tranche led by WestBridge Capital marks an important milestone in India’s climate tech journey.

The funding reflects growing investor belief in:

- Nature-based climate solutions

- Carbon market potential

- Sustainable agricultural transformation

As climate action becomes central to global economic planning, Indian climate tech startups are stepping into a critical role.

For investors, entrepreneurs, and policymakers, this development signals that climate innovation is not just an environmental necessity — it is also an emerging growth opportunity.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Last Updated on Thursday, February 12, 2026 6:22 am by Startup Newswire Team