Bengaluru EV Startup River in Talks to Raise $80M at $200M Valuation

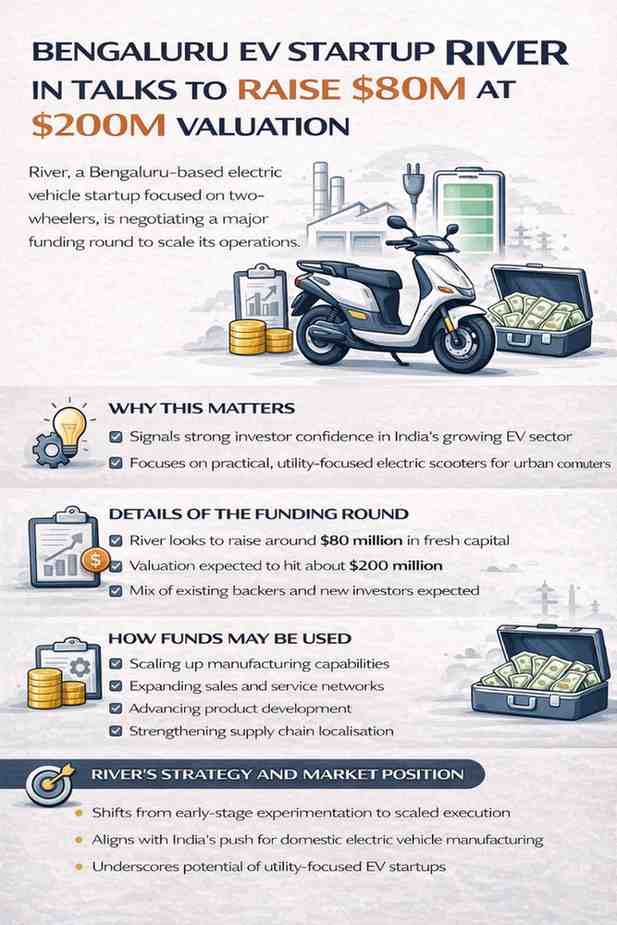

Bengaluru-based electric vehicle startup River is in talks to raise around $80 million at a valuation of nearly $200 million, marking a major moment for India’s fast-evolving EV ecosystem.

The potential funding round highlights renewed investor interest in electric mobility, especially in companies focused on practical design, manufacturing depth, and long-term scale.

If completed, the round would place River among the more highly valued young EV startups in India, at a time when funding has become selective and performance-driven.

Why This Funding Development Matters

India’s EV sector is entering a critical growth phase.

Policy support, rising fuel costs, and improving charging infrastructure are pushing more consumers towards electric two-wheelers.

At the same time, investors are backing companies that show product differentiation and clear paths to scale. River’s talks signal confidence in its approach to electric mobility, manufacturing, and brand positioning.

About River: A Bengaluru-Born EV Startup

River is an electric vehicle startup headquartered in Bengaluru. The company focuses on electric two-wheelers designed for daily use, combining utility, performance, and durability.

River is best known for its electric scooter, which has been positioned as a lifestyle and utility-focused vehicle rather than a purely commuter product.

Details of the Proposed Funding Round

According to industry sources, River is in discussions to raise around $80 million in fresh capital.

The talks value the company at approximately $200 million, though the final numbers may change based on investor interest and deal structure.

The round is expected to include a mix of existing backers and new investors, though official confirmations have not yet been made public.

How the Funds Could Be Used

The fresh capital is expected to support River’s next phase of growth.

Key focus areas may include:

- Scaling manufacturing capacity

- Expanding sales and service networks

- Product development and platform upgrades

- Strengthening supply chain and localisation

As competition intensifies, capital efficiency and execution will be closely watched.

River’s Product Strategy and Market Position

River has taken a distinct approach in the electric two-wheeler market.

Instead of focusing only on range or speed numbers, the company has emphasised:

- Strong build quality

- High storage capacity

- Everyday usability

- Design-led differentiation

This positioning aims to attract urban riders looking for practicality without compromising on performance.

Manufacturing and Localisation Focus

Manufacturing depth is a key part of River’s strategy.

The company has invested in setting up production capabilities in Karnataka, with a focus on in-house engineering and design.

Higher localisation not only helps control costs but also aligns with India’s broader push for domestic manufacturing in the EV sector.

Why Investors Are Paying Attention

Investor interest in River reflects a shift in how EV startups are being evaluated.

Instead of chasing rapid expansion alone, investors are now looking for:

- Strong product-market fit

- Manufacturing readiness

- Sustainable unit economics

- Clear differentiation

River’s design-first and utility-driven approach appears to have resonated with this new investment lens.

India’s Electric Two-Wheeler Market Context

Electric two-wheelers account for the largest share of India’s EV sales.

With daily commuting needs and cost sensitivity, scooters and motorcycles are driving EV adoption.

Government incentives, state-level EV policies, and falling battery costs continue to support growth, even as competition remains intense.

Competitive Landscape

River operates in a crowded space with multiple electric scooter brands targeting urban consumers.

Competition has pushed companies to innovate on:

- Battery safety

- Software features

- Charging convenience

- After-sales service

In this environment, brand identity and customer experience play an increasing role in long-term success.

Challenges Ahead for River

Despite strong interest, challenges remain.

Electric vehicle startups face pressure on margins due to battery costs, supply chain volatility, and price competition. Building a reliable service network is also capital-intensive.

Execution over the next few years will be critical in justifying premium valuations.

Valuation in the Current Funding Climate

A $200 million valuation stands out in today’s cautious funding environment.

Investors are no longer rewarding growth at any cost.

This suggests that River’s fundamentals, product roadmap, and long-term vision are being viewed positively during negotiations.

What This Means for Bengaluru’s Startup Ecosystem

Bengaluru continues to be a major hub for EV and deep-tech startups.

River’s funding talks reinforce the city’s role as a centre for electric mobility innovation, combining engineering talent, manufacturing ambition, and investor access.

Broader Signal for Indian EV Startups

The potential deal sends a wider signal to the EV ecosystem.

Capital is still available for companies that show:

- Clear differentiation

- Strong leadership

- Realistic growth plans

This could encourage other startups to focus on fundamentals rather than rapid expansion alone.

What Comes Next

River is expected to continue discussions with investors in the coming weeks.

If the round closes successfully, attention will shift to how the company deploys capital and expands its presence beyond initial markets.

No official announcement has been made yet, and details remain subject to change.

Why This Is a Key Moment for River

The funding talks mark a transition from early-stage experimentation to scaled execution.

A larger balance sheet would give River the ability to compete more aggressively while investing in quality and reliability.

For customers, this could mean better availability, stronger service support, and faster innovation cycles.

Big Picture

India’s EV story is moving into a more mature phase.

Companies like River represent a new generation of startups that blend design, manufacturing, and technology, rather than focusing on just one aspect.

Investor backing at this stage reflects confidence in that integrated approach.

Bottom Line

Bengaluru-based EV startup River’s talks to raise $80 million at a $200 million valuation underline strong investor confidence in its vision and execution.

While challenges remain, the proposed funding round could provide the momentum needed to scale operations and strengthen its position in India’s competitive electric two-wheeler market.

As the EV sector evolves, River’s next moves will be closely watched by investors, rivals, and consumers alike.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Last Updated on Tuesday, February 10, 2026 7:13 am by Startup Newswire Team