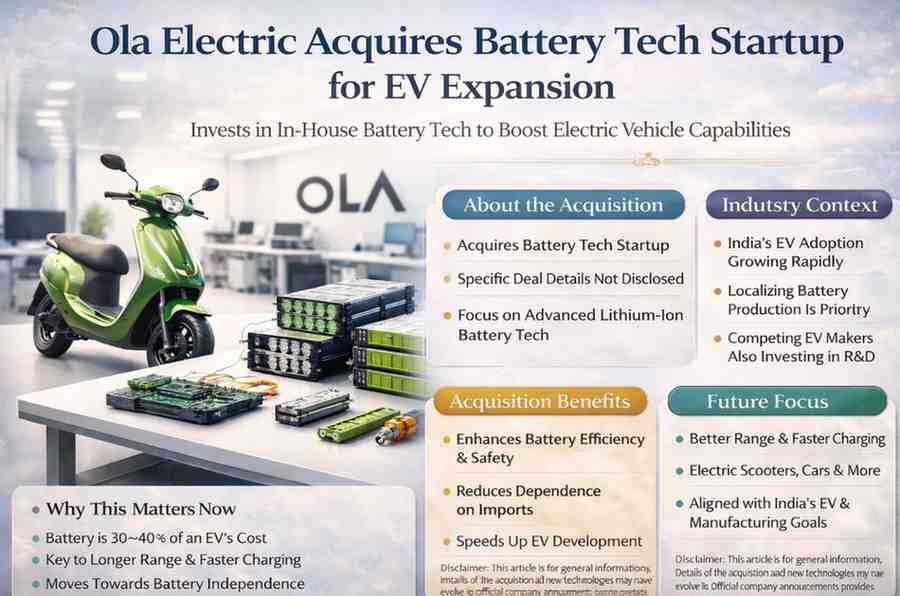

Ola Electric Acquires Battery Tech Startup for EV Expansion

Ola Electric has acquired a battery technology startup as part of its long-term strategy to strengthen its electric vehicle (EV) ecosystem and reduce dependence on external suppliers. The acquisition marks a key step in Ola Electric’s push towards deeper vertical integration, at a time when battery performance, cost, and supply security are becoming critical to the EV industry.

While the financial details of the deal have not been disclosed, the move is being seen as a strategic investment aimed at improving battery efficiency, lowering costs, and supporting Ola Electric’s future product roadmap.

Why This Acquisition Matters Today

Batteries account for 30–40% of an electric vehicle’s total cost. Control over battery technology is now a major competitive advantage for EV makers.

For Ola Electric, this acquisition matters because it:

- Strengthens in-house battery research and development

- Reduces reliance on imported battery cells

- Supports long-term cost control

- Improves performance, safety, and charging speed

The deal comes as India accelerates its shift towards electric mobility, backed by policy support and rising consumer demand.

What Ola Electric Has Acquired

According to industry sources, the acquired startup specialises in:

- Advanced lithium-ion battery chemistry

- Battery management systems (BMS)

- Thermal safety and energy optimisation

The startup’s engineering team and intellectual property will be integrated into Ola Electric’s existing battery and vehicle development units.

Ola Electric has not announced the startup’s name publicly, but sources say it has been working closely with the company for pilot projects over the past year.

Ola Electric’s Vision: End-to-End EV Control

From Vehicles to Batteries

Ola Electric has consistently stated its ambition to become a full-stack EV company, covering:

- Vehicle design and manufacturing

- Software and connectivity

- Battery cells and packs

- Charging infrastructure

The battery startup acquisition fits directly into this strategy.

Reducing Supply Chain Risks

Global battery supply chains have faced:

- Price volatility

- Geopolitical risks

- Shipping delays

By owning more of the battery value chain, Ola Electric aims to ensure stable supply and predictable costs.

How the Acquisition Supports Ola’s EV Expansion Plans

Faster Product Development

In-house battery expertise allows:

- Faster testing of new battery chemistries

- Better alignment between vehicle design and battery layout

- Shorter development cycles for new models

Improved Range and Charging

Battery innovation directly impacts:

- Vehicle range per charge

- Charging time

- Long-term battery health

These factors are crucial for customer adoption in India, where range anxiety remains a concern.

Impact on Ola Electric’s Future Vehicles

Ola Electric is expected to use the acquired technology across:

- Electric scooters

- Upcoming electric motorcycles

- Future electric cars

Better batteries could lead to:

- Higher real-world range

- Improved safety under Indian weather conditions

- Lower long-term ownership costs

India’s EV Battery Race Is Heating Up

Ola Electric is not alone in focusing on batteries. Across India:

- EV makers are investing in battery R&D

- Startups are working on alternative chemistries

- Governments are pushing for local manufacturing

The acquisition highlights how battery technology is becoming the core battleground of the EV industry.

Alignment With India’s EV and Manufacturing Push

The move also aligns with:

- India’s push for local manufacturing

- Reduced dependence on imports

- Long-term energy security goals

Battery localisation is seen as essential for making EVs affordable at scale.

What This Means for Consumers

In the long run, consumers could benefit from:

- More affordable electric vehicles

- Better range and reliability

- Improved safety standards

- Faster charging options

However, these benefits will depend on how quickly Ola Electric integrates the technology into mass production.

No Immediate Price Impact Announced

Ola Electric has not announced:

- Any immediate price cuts

- Changes to existing models

- New product launch timelines linked to the acquisition

Industry experts say battery innovation typically takes 12–24 months to reflect in commercial products.

Market Reaction and Industry View

Analysts view the acquisition as:

- A long-term strategic move

- A signal of Ola Electric’s seriousness about battery leadership

- A step towards improving margins over time

The market increasingly rewards EV companies that show control over core technologies rather than just assembly.

Challenges Ahead

Despite the strategic benefits, challenges remain:

- Scaling battery technology safely

- Managing high R&D costs

- Competing with global battery leaders

- Ensuring consistent quality at scale

Execution will be critical to turning the acquisition into a competitive advantage.

What Comes Next for Ola Electric

Going forward, Ola Electric is expected to:

- Expand its battery research team

- Invest further in cell manufacturing

- Test new chemistries for Indian conditions

- Align battery development with future vehicle platforms

The company’s long-term goal remains building a globally competitive EV ecosystem from India.

Final Word

Ola Electric’s acquisition of a battery technology startup marks a decisive move towards deeper control over the most critical component of electric vehicles. As India’s EV market grows, such strategic investments could shape which companies lead the next phase of electric mobility.

For Indian consumers and investors, the message is clear: the future of EV competition will be decided as much in battery labs as on the roads.

Disclaimer

This article is for general informational purposes only. Details related to acquisitions, technology development, and business strategy are subject to change based on official disclosures. Readers are advised to verify information from company announcements and regulatory filings before making financial or business decisions.

Financial Disclaimer

Markets and investment-related decisions involve risks and uncertainties. Readers should conduct their own research and consult qualified professionals before making investment or business decisions.

Last Updated on Friday, February 6, 2026 12:24 pm by Startup Newswire Team