Neysa Secures $600M Equity Round Led by Blackstone for AI Expansion in India

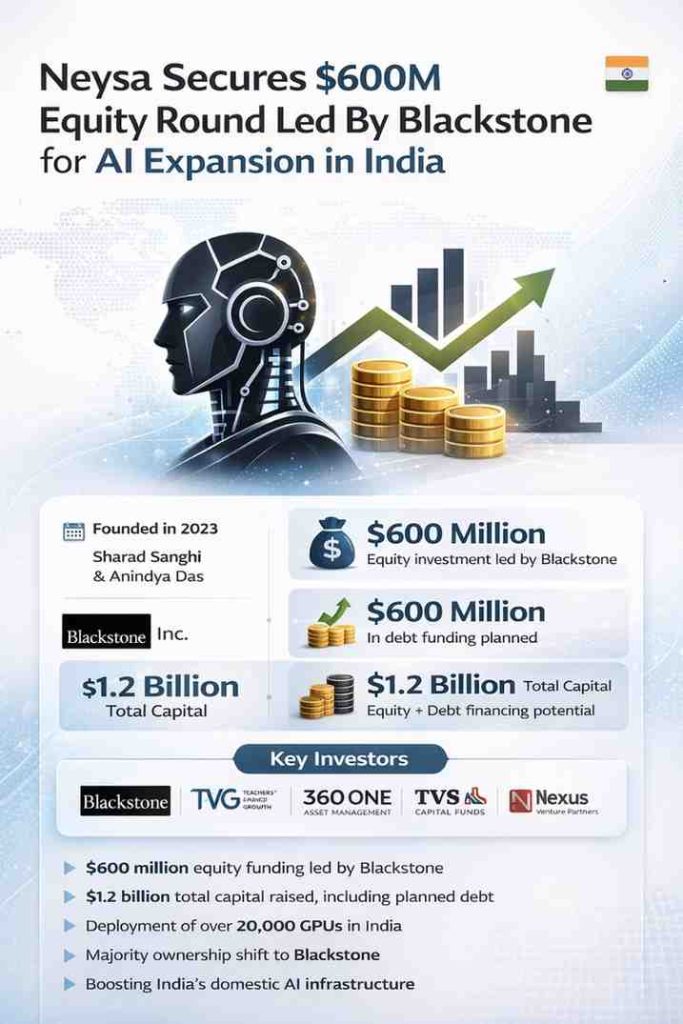

Indian AI infrastructure startup Neysa has secured a major $600 million equity investment led by U.S. private equity giant Blackstone Inc., marking one of the largest funding commitments in India’s fast-growing artificial intelligence sector.

The transaction also includes plans to raise an additional $600 million in debt, taking the total funding package to up to $1.2 billion, according to reports by The Times of India and Moneycontrol.

The capital will be used to expand AI compute capacity across India, strengthening domestic infrastructure at a time when demand for high-performance computing is rising sharply.

Why This Deal Matters for India’s AI Ecosystem

The funding signals growing global confidence in India’s AI infrastructure space. As enterprises and government agencies increase investments in AI-driven services, access to reliable and scalable computing power has become critical.

Neysa’s expansion aligns with India’s broader push to build sovereign AI capacity under initiatives such as the IndiaAI Mission, reducing dependence on overseas cloud infrastructure.

For India’s technology sector, this deal is not just about funding. It represents a structural shift toward building local AI backbone infrastructure.

Details of the $600 Million Equity Investment

Blackstone Leads the Round

The $600 million equity round is led by Blackstone, one of the world’s largest alternative investment firms with deep exposure to infrastructure and technology investments globally.

Reports indicate that Blackstone is expected to acquire a majority stake in Neysa as part of the deal, strengthening its influence over the company’s long-term strategy.

Other Key Investors Participate

Alongside Blackstone, several prominent investment firms participated in the round, including:

- Teachers’ Venture Growth

- TVS Capital Funds

- 360 ONE Asset Management

- Nexus Venture Partners

The combination of global and domestic investors reflects confidence in India’s AI infrastructure opportunity.

Total Capital Could Reach $1.2 Billion

In addition to equity, Neysa plans to secure $600 million in debt financing, bringing total capital availability to $1.2 billion. This blended funding model allows the company to scale infrastructure while maintaining financial flexibility.

What Neysa Does

Founded in 2023 by Sharad Sanghi and Anindya Das, Neysa operates in the AI infrastructure segment.

The company provides a GPU-based cloud platform designed specifically for AI workloads. Its services support:

- AI model training

- Machine learning applications

- High-performance computing

- Large language model deployment

Unlike traditional cloud platforms, Neysa focuses on GPU-as-a-Service, enabling businesses to access powerful computing clusters without building their own data centres.

Why GPUs Are Central to AI Growth

Modern AI models require enormous computing power. Graphics Processing Units (GPUs) are essential for training and running large AI systems.

Globally, GPU supply has been tight. Many Indian startups and enterprises rely on foreign hyperscale cloud providers for access. This creates concerns around cost, latency, and data sovereignty.

Neysa aims to address this gap by building high-density GPU clusters within India.

How the Funds Will Be Used

Deployment of Over 20,000 GPUs

According to industry reports, Neysa plans to deploy more than 20,000 GPUs across Indian data centres. This scale of deployment would significantly increase domestic AI compute capacity.

Such infrastructure is critical for:

- Enterprise AI adoption

- Startup innovation

- Research institutions

- Government digital services

Expansion of AI Data Centres

The company will invest in expanding its AI compute facilities across India. This includes scaling existing centres and potentially developing new infrastructure.

The objective is to create a reliable, large-scale AI backbone capable of supporting both commercial and public-sector workloads.

Strengthening AI Research and Enterprise Adoption

By improving access to local GPU clusters, Neysa aims to enable faster AI model training and deployment. Sectors that could benefit include:

- Healthcare

- Financial services

- Manufacturing

- Public services

- Education technology

Improved infrastructure can reduce turnaround time for AI development projects and lower operational costs.

Alignment with IndiaAI Mission

The investment comes as India actively promotes domestic AI capabilities under the IndiaAI Mission.

Building local compute infrastructure reduces dependency on foreign platforms and strengthens data control. It also improves resilience in a rapidly evolving global AI environment.

This funding round therefore supports both private sector growth and national digital priorities.

What This Means for India’s Tech Landscape

Boost to Sovereign AI Infrastructure

With expanded GPU capacity, India will be better positioned to host and scale AI applications domestically. This reduces risks related to cross-border data transfer and compute limitations.

Stronger Investment Momentum

Large-scale backing from Blackstone could encourage further international investments into Indian AI startups.

It also signals that AI infrastructure not just AI software is becoming a key investment theme.

Job Creation and Ecosystem Growth

Infrastructure expansion typically creates demand for:

- Data centre engineers

- Cloud architects

- AI specialists

- Operations teams

As compute capacity grows, the broader AI ecosystem may also see new startups and enterprise projects emerge.

Blackstone’s Strategic Interest

Blackstone has a history of investing in infrastructure, technology, and digital platforms globally. Its decision to back Neysa reflects confidence in India’s long-term AI demand story.

The firm’s participation may also bring operational expertise and access to global networks.

Looking Ahead

With up to $1.2 billion in funding, Neysa is positioned to become a significant player in India’s AI infrastructure market.

The success of this expansion will depend on execution, GPU availability, enterprise demand, and regulatory alignment.

However, the scale of this funding clearly places Neysa among the most well-capitalised AI infrastructure companies in India.

For India’s digital economy, this development marks an important milestone — one that highlights the growing intersection of global capital and domestic AI ambition.

Key Takeaways

- $600 million equity round led by Blackstone

- Additional $600 million debt planned

- Total potential funding: $1.2 billion

- Over 20,000 GPUs to be deployed in India

- Founded in 2023 by Sharad Sanghi and Anindya Das

As AI adoption accelerates across industries, infrastructure investment of this scale could play a decisive role in shaping India’s position in the global AI landscape.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Last Updated on Tuesday, February 17, 2026 5:42 am by Startup Newswire Team