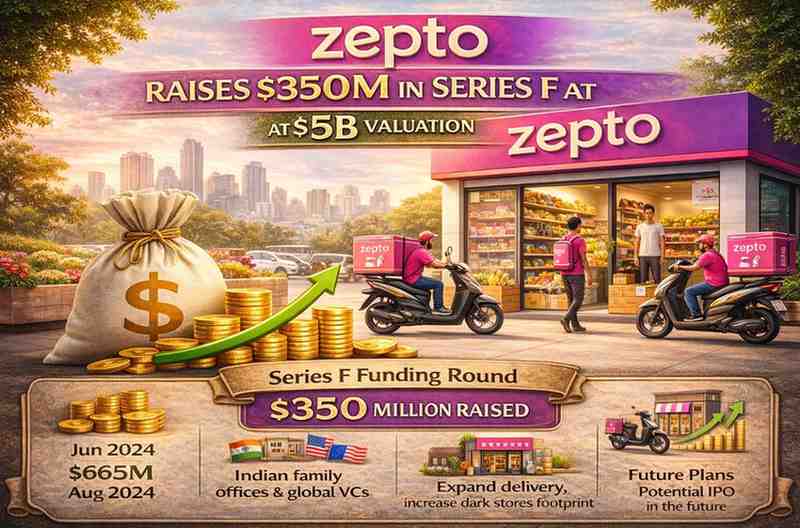

Zepto raises $350 million in Series F at $5 billion valuation

Zepto, a Bengaluru-headquartered quick commerce company known for ultra-fast grocery and essentials delivery, has raised $350 million in a new funding round at a roughly $5 billion valuation, industry sources and company disclosures indicate. The capital comes as part of Zepto’s continued fundraising activity in 2024 and 2025, following earlier large rounds, and positions the startup among India’s most-funded private technology companies. The funds are earmarked for scaling operations, enhancing logistics capacity and preparing for a potential initial public offering (IPO) in coming years.

Background: Zepto’s rise in India’s quick commerce landscape

Zepto was founded in July 2021 by Aadit Palicha and Kaivalya Vohra, two young entrepreneurs who re-engineered the concept of grocery and essentials delivery by promising orders in as little as 10 minutes. From its initial operations in major Indian metros, Zepto rapidly expanded its “quick commerce” footprint through a dense network of so-called dark stores micro-fulfilment centres located close to residential areas designed to enable rapid delivery.

The startup competes in a crowded market that includes rivals such as Blinkit (formerly part of Zomato), Swiggy’s Instamart division and BigBasket Now, all of which are vying for urban customer share in instant delivery of groceries and essentials. Quick commerce is widely viewed as an outgrowth of India’s broader e-commerce boom, accelerated by digital adoption during the pandemic and sustained by consumer demand for convenience. Zepto’s model combines inventory management, supply-chain optimisation, data analytics and a scalable dark store network in pursuit of rapid fulfilment a model that has attracted significant venture capital interest.

Over the past few years, Zepto has moved from early seed raises to large late-stage funding rounds, achieving unicorn status (a valuation of $1 billion or more) as early as August 2023 and progressing through successive capital infusions that reflect investor confidence in its growth trajectory.

Series F: size, valuation and investor participation

According to filings and funding trackers, Zepto’s recent round widely referred to in industry reports as part of its ongoing Series F fundraising brought in $350 million while holding its valuation at around $5 billion. Local and international media posts indicate this funding round was led by domestic backers, including private wealth divisions and family offices, increasing the share of Indian investor participation.

This funding milestone follows earlier rounds in 2024 and 2023:

- In June 2024, Zepto raised $665 million in what was then termed a Series F round at a valuation of about $3.6 billion, led by institutional venture firms.

- Subsequently, in August 2024, Zepto raised $340 million in a follow-on financing, lifting its valuation to approximately $5 billion.

Collectively, these fundraising events contributed to more than $1 billion in capital raised in a single calendar year, underscoring the intensity of investor interest in the company’s quick commerce platform.

Developments leading up to the latest raise

Zepto’s most recent capital infusion comes against a backdrop of both strong operational expansion and increased competition in India’s quick commerce sector.

In 2024 and early 2025, the company’s growth strategy involved expanding its dark store footprint across multiple Indian cities, deepening penetration in existing markets and enhancing its last-mile logistics infrastructure. Reports suggest Zepto aimed to grow its gross order value rapidly, with annualised figures reaching several billions of dollars as the scale of transactions expanded.

The company also engaged in efforts to broaden its investor base by attracting participation from domestic firms and family offices, in addition to its established international venture partners. This shift reflected a broader trend in India’s startup ecosystem, where local institutional capital and high-net-worth investors have increasingly backed high-growth technology firms.

Market context also shaped Zepto’s fundraising strategy. The broader quick commerce industry faced a period of reevaluation as unit economics, profitability and path-to-sustainable margins became central themes for investors after several years of rapid customer acquisition and subsidised pricing models. Yet Zepto’s ability to secure substantial funding rounds in this environment underscores continued belief in its business model.

Operational impact: scaling and competition

Securing capital at significant valuations enables Zepto to pursue operational milestones at scale. The company’s ability to raise capital influences expansion plans, including the opening of new dark stores in urban and suburban markets, enhancement of delivery networks, and potential diversification of offerings beyond groceries into adjacent categories.

Operationally, Zepto’s growth has been accompanied by competitive dynamics with larger platforms. Blinkit, acquired by Zomato’s parent entities, has pursued aggressive expansion of its own dark store network, while Swiggy’s Instamart division and BigBasket Now have leveraged their parent companies’ broader logistics ecosystems. In this competitive field, Zepto’s capital reserves provide financial runway to sustain growth initiatives amid shifting market conditions.

Additionally, the company has emphasised efficiency improvements and unit economics enhancement as central components of its scaling strategy. While high order volumes are critical for market leadership, improving profitability metrics such as earnings before interest, tax, depreciation and amortisation (EBITDA) remains a priority for investors and management alike.

Impact on India’s startup ecosystem

Zepto’s latest funding round and robust valuation resonate beyond the company itself, highlighting continuing investor appetite for high-growth technology platforms in India.

India’s startup ecosystem has matured into one of the world’s most active markets for venture capital deployment, particularly in sectors tied to consumer internet, logistics, fintech and platform economies. Zepto’s ability to attract large funding rounds signals that despite macroeconomic headwinds and periodic valuation corrections, venture capital continues to underwrite ambitious technology and logistics plays.

For other Indian startups, Zepto’s fundraising success reinforces the viability of scaling consumer-facing platforms at pace, even where unit economics and path-to-profitability are still evolving. It also highlights the role of domestic capital in augmenting traditional venture investment, a trend that may shape future funding cycles across sectors.

From a policy and market standpoint, India’s positioning as a major venture capital destination with active participation from both global firms and Indian institutional investors reflects confidence in the long-term growth prospects of its digital economy and consumer service markets.

Preparations for a potential IPO

Funding rounds of this scale often precede discussions around public market listings. Industry reports have suggested Zepto’s intention to explore an initial public offering (IPO) in the medium term as part of its capital strategy, although executives have not publicly confirmed specific timelines for such a move.

Preparations for an IPO typically involve strengthening governance structures, improving financial transparency, and aligning the ownership base to appeal to public market investors. Zepto’s fundraising and investor diversification efforts may be interpreted as incremental milestones in this broader corporate evolution a strategic positioning that aligns with public market expectations for growth track records and market leadership.

Challenges and risk considerations

While Zepto’s funding trajectory highlights investor confidence, challenges accompany rapid scale expansion. Quick commerce models inherently operate on thin margins, with high costs tied to delivery logistics, dark store operations, and customer incentives.

Critics of the industry have noted that sustained profitability remains a challenge, with promotional spending and subsidised pricing often used to attract and retain customers. Such strategies can compress margins and place pressure on cash reserves, especially in competitive markets where multiple players vie for customer share.

Human capital and operational management are additional variables. Coordinating a large fleet of delivery personnel, managing inventory across dense dark store networks, and ensuring timely fulfilment without inflating cost structures require sophisticated technology and operational oversight. Any misalignment between expansion pace and operational efficiency can impact financial performance.

Regulatory and labour considerations also shape the operational landscape. As quick commerce involves gig economy workers, policies around worker protections, benefits, and classification have broader implications for cost structures and compliance. These factors, while external to funding, influence the broader risk profile for companies in this market segment.

Conclusion

Zepto’s $350 million raise at a $5 billion valuation represents a significant episode in India’s quick commerce funding narrative, reaffirming venture investor interest in high-growth delivery platforms despite competitive and profitability pressures. The company’s ability to attract capital at strong valuations equips it with resources to scale operations, enhance logistical infrastructure and potentially prepare for public market entry in the future. For India’s startup ecosystem, the funding round signals ongoing confidence in consumer technology ventures that blend logistics, digital interfaces and changing urban consumption patterns a trend likely to shape growth strategies across the tech landscape in the years ahead.

Disclaimer:

This article is based on publicly available information, regulatory filings, company disclosures, and reporting by credible news organisations available at the time of publication. While due care has been taken to ensure factual accuracy and editorial integrity, financial figures, business metrics, regulatory processes, and market conditions may change as additional disclosures are made or official documents are updated. References to financial performance, fundraising activity, or potential public listings are for informational and journalistic purposes only and do not constitute investment advice or recommendations. Readers are advised to consult official filings, audited financial statements, and regulatory communications for the most current and authoritative information. The publication assumes no responsibility for decisions made based on the contents of this article.

Last Updated on Thursday, February 5, 2026 7:27 am by Startup Newswire Team