PhonePe Advances IPO Plans with Updated DRHP After SEBI Observations

Digital Payments Major Moves Closer to Stock Market Debut

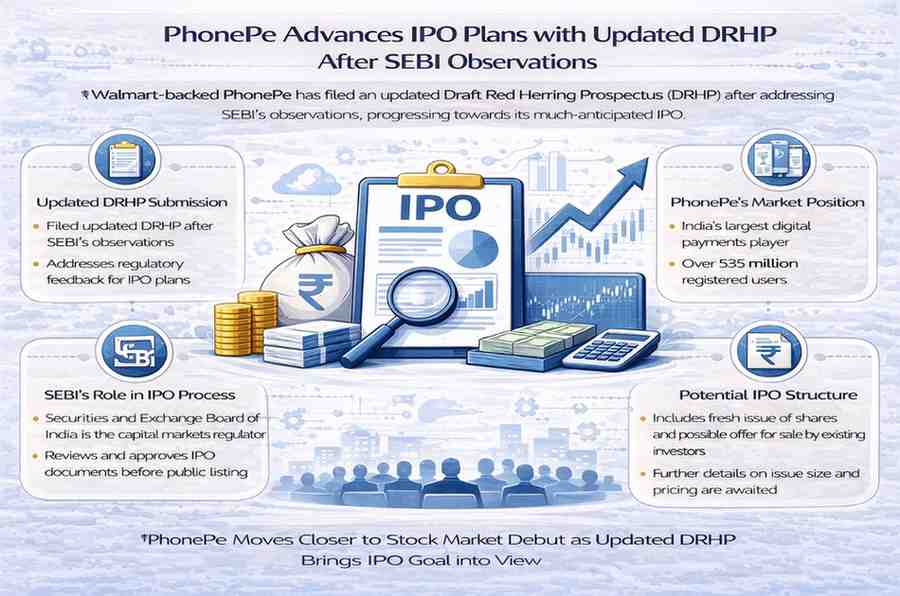

Walmart-backed fintech company PhonePe has taken a fresh step toward its much-anticipated initial public offering (IPO) by filing an updated Draft Red Herring Prospectus (DRHP) after receiving observations from the Securities and Exchange Board of India (SEBI).

The development signals that one of India’s largest digital payments platforms is moving ahead with plans to list on Indian stock exchanges. For investors and market watchers, PhonePe’s IPO is expected to be one of the most closely tracked public issues in India’s fintech space.

The updated DRHP filing comes after SEBI reviewed the earlier submission and issued observations, a standard regulatory step before companies proceed with an IPO.

Why PhonePe’s IPO Matters

PhonePe is among India’s largest digital payments companies by transaction volume. Its public listing would mark a major milestone for the country’s fintech sector.

The IPO is significant because:

- It reflects the maturity of India’s digital payments ecosystem

- It may attract strong investor interest in fintech stocks

- It signals confidence in long-term digital finance growth

India’s Unified Payments Interface (UPI) ecosystem has seen rapid adoption in recent years, and companies like PhonePe have played a central role in this expansion.

What Is a DRHP and Why Is It Important?

A Draft Red Herring Prospectus (DRHP) is a key document filed by companies planning to go public. It contains detailed information about:

- Business operations

- Financial performance

- Risk factors

- Shareholding structure

- Proposed use of IPO proceeds

After filing the DRHP, SEBI reviews the document and may issue observations or seek clarifications. Once the company addresses these observations, it can proceed toward launching the IPO.

PhonePe’s updated DRHP indicates that the company has incorporated SEBI’s feedback.

SEBI’s Role in the IPO Process

The Securities and Exchange Board of India is the regulator overseeing capital markets in India.

Before approving any IPO, SEBI examines:

- Disclosure quality

- Financial transparency

- Risk disclosures

- Compliance with regulations

SEBI’s observations do not necessarily mean rejection. They often include requests for clarification or additional disclosures.

The updated filing suggests that PhonePe is progressing through this regulatory process.

PhonePe’s Business Model and Growth

Founded in 2015, PhonePe has grown into one of India’s leading digital payments platforms.

It offers services such as:

- UPI-based payments

- Merchant transactions

- Insurance products

- Financial services distribution

- Mutual fund investments

The company competes with major players in India’s fintech sector and has benefited from the rapid growth of digital transactions nationwide.

PhonePe is backed by global retail giant Walmart, which acquired majority ownership after separating it from Flipkart’s ownership structure.

India’s Booming Digital Payments Market

India has emerged as one of the world’s largest real-time payments markets.

The UPI system, operated by the National Payments Corporation of India (NPCI), has driven exponential growth in digital transactions.

Key trends include:

- Rising smartphone penetration

- Expanding internet access

- Government push for digital payments

- Growing merchant acceptance

PhonePe has consistently been among the top UPI apps by transaction volume, making it a key player in the ecosystem.

Potential Structure of the IPO

While final details will be available in the updated DRHP and subsequent prospectus, IPOs typically include:

- Fresh issue of shares

- Offer for sale by existing investors

- Listing on Indian stock exchanges

The exact issue size, valuation, and price band will be disclosed closer to the launch date.

Investors will closely examine financial performance and growth projections once the final prospectus is available.

Investor Interest in Fintech IPOs

Fintech IPOs in India have attracted mixed reactions in recent years.

Investors have become more cautious, focusing on:

- Profitability

- Sustainable growth

- Unit economics

- Regulatory compliance

PhonePe’s strong market position in digital payments may attract attention, but market sentiment at the time of launch will play a crucial role.

Regulatory Environment for Digital Payments

India’s fintech sector operates under evolving regulatory frameworks.

Regulators focus on:

- Data protection

- Consumer safety

- Payment security

- Competition in the digital payments market

As one of the largest players, PhonePe’s compliance track record and governance standards will be carefully evaluated by investors.

Strategic Timing of the IPO

The timing of PhonePe’s IPO will depend on multiple factors:

- Market conditions

- Investor appetite

- Broader economic outlook

- Regulatory clearances

Companies often wait for stable market conditions to ensure strong subscription levels.

The updated DRHP suggests that PhonePe intends to move forward when conditions are favourable.

Implications for India’s Startup Ecosystem

PhonePe’s IPO could have broader implications for India’s startup ecosystem.

A successful listing may:

- Encourage other fintech firms to consider IPOs

- Improve investor confidence

- Strengthen India’s public market pipeline

Over the past few years, several Indian startups have explored public listings as part of long-term growth strategies.

PhonePe’s size and market presence make it one of the most anticipated fintech IPOs.

What Investors Should Watch

Before investing, market participants typically review:

- Revenue growth trends

- Path to profitability

- Competition landscape

- Regulatory risks

- Use of IPO proceeds

The updated DRHP will provide deeper insights into these aspects.

Retail and institutional investors alike will monitor official announcements for final details.

Conclusion

PhonePe’s decision to file an updated DRHP after SEBI observations marks a key step in its IPO journey.

As one of India’s leading digital payments companies, its listing could become a defining moment for the fintech sector.

The move reflects the continued strength of India’s digital economy and the increasing readiness of large tech firms to tap public markets.

While final timelines and pricing details remain awaited, PhonePe’s progress toward an IPO will remain a major focus for investors, fintech professionals, and market observers across India.

Disclaimer: The information presented in this article is intended for general informational purposes only. While every effort is made to ensure accuracy, completeness, and timeliness, data such as prices, market figures, government notifications, weather updates, holiday announcements, and public advisories are subject to change and may vary based on location and official revisions. Readers are strongly encouraged to verify details from relevant official sources before making financial, investment, career, travel, or personal decisions. This publication does not provide financial, investment, legal, or professional advice and shall not be held liable for any losses, damages, or actions taken in reliance on the information provided.

Financial Disclaimer: Markets and investment-related products are subject to risks and fluctuations. Readers should conduct their own research and consider consulting a qualified financial advisor before making any investment decisions.

Last Updated on Monday, February 16, 2026 10:59 am by Startup Newswire Team